Chapter 5: Effective cashless payment methods for business in European countries

Greece

PayPal is an online payment gateway that handles money transfers over the Internet. PayPal serves as an online alternative to traditional methods such as checks and payment orders. PayPal requires no additional (possibly costly) security or encryption measures for company’s website, it is an internationally recognized service and trusted payment platform and, finally, everyone can pay with a credit or debit card, even if they do not have a PayPal account.

Skrill, like PayPal, is an online payment gateway that handles money transfers over the Internet. Its advantages are the exchange rate, offering payments in 40 currencies and 200 countries; it has an established presence in the European Union, and it offers the Skrill VIP policy, in case your business’ transactions exceed € 6000 within a quarter, you automatically receive the privileges of your Skrill VIP account.

The Greek company Viva Wallet is an electronic money institution licensed by the Bank of Greece. It provides businesses with almost all the services provided by the services, but it also has some that make it stand out. The most important additional benefit is the ability to use POS (Point of Sales – cash register) for trade stores and service companies, which is connected to your e-wallet and allows you to accept electronic payments to your trade or service company (Ergoq, 2021).

Romania

Cargus Romania and Alpha Bank Romania have signed a partnership to provide in the local market the most advanced card acceptance payment solution for delivery services.

Alpha PhonePOS is the first application launched by a Romanian bank which is capable to transform an Android mobile device into a POS terminal and allows contactless payment acceptance of debit and credit card or through other NFC equipped devices. By integrating this new technology into Android PDA terminals, Cargus will provide to their client’s access to a flexible and secure card on delivery payment method without additional equipment.

The specificity of the Romanian market, however, is that consumers often pay in cash for online purchases. According to Cargus data, as many as 65% of all online buyers choose the cash on delivery option when delivering their parcel.

Payment for the parcel at the Cargus courier is as simple as an in-store payment. It can be performed using a contactless payment card, a digital wallet phone or other wearable with contactless option. The payment instrument will be read using Near

Study case

Due to the raising popularity and wide adoption of contactless payments, Romania ranks fifth in Europe, a survey by Mastercard shows. According to the company, 2 out of 3 electronic payments made with Mastercard are contactless.

According to a survey by Mastercard, the popularity of contactless payments has seen a huge increase. Between January-August 2018, the number of such payments went up by 139 percent year-on-year, representing 70 percent of the total payments made to retailers.

The Mastercard study for Europe shows that more than 50 percent of contact cards with Mastercard cards are in over 15 European markets – including Romania, Denmark, Croatia, Greece, Hungary, the Netherlands, Poland and Russia. Continuous technological advances in payments and data analysis across Europe allow countries to continually optimize regional technology infrastructure. Consequently, each country is able to operate in a more integrated and efficient manner.

Mastercad has supported contactless payments in Romania by investing in the contactless ecosystem, more than the existence of cards on the market, integrating contactless transactions, increased communication and providing education and training to consumers.

There are some steps already done, from using the physical token to the more innovative smart token, owners of a Mastercard can use them all.

The study also shows that European countries are dramatically changing their behaviour regarding adopting the contactless technology, with countries like Romania accounting for almost 70 percent of contactless transactions out of the total transactions made with retailers. Many European countries embrace the cashless economy, as demonstrated by cash withdrawal and rapid adoption rate of contactless technology.

Poland

Cashless payments have become a norm for the past few years. Majority of people don’t carry cash around anymore. Cashless payment methods not only shorten checkout times, but also solve fraud and undeclared purchases that lead to tax loopholes.

Blik – (https://www.blik.com/) it is an easy and quick payment method for not only cash deposits and withdrawals, but also payments at stores and online. Payment card or wallet are not needed to pay with BLIK. All you need is a phone with internet access and the bank’s app. The BLIK code is a unique 6-digit code in the bank’s app that is valid for 2 minutes. After this time has elapsed, a new one can be generated. The code is used to initiate payments.

Paybylink – (https://paybylink.pl/) it is the most used e-banking payment method for online shops and auction sites. When making a purchase in an online shop, the customer will receive a payment link as an e-mail or a direct transfer from the shopping page. The buyer merely confirms the process, and the seller doesn’t have to wait long for the money to be credited. The data required for the transfer will be completed by the bank with the support of Paybylink. This eliminates the risk of entering the wrong account number or entering the wrong amount.

Przelewy24 – (https://www.przelewy24.pl/) is Poland’s largest online payment operator, providing innovative e-commerce solutions. The Przelewy24 service supports transactions on all devices and with a variety of payment methods, including fast transfers, BLIK, payment cards, mobile payments, e-wallets, and instalments. It enables the transfer to be processed, which can take anywhere from a few minutes to several days. When you make a payment, you are redirected to the Przelewy24 system or to your bank’s system, where you will be presented with a transfer form for confirmation. Transfers for online purchases or other transactions are free and secure for the customer. The recipient of the payment pays the transaction costs.

Scotland

Revolut is a British Financial technology company that offers banking services (https://en.wikipedia.org/wiki/Revolut).

It was founded in 2015 by Vladimir and Nikolai and is headquartered in London. It offers many possibilities such as currency transactions, bank accounts in GBP and EUR, virtual cards, contactless payments, stock transactions without commission, while now it also offers cryptocurrency exchange and peer-to-peer payments. In January 2021 it applied for a banking license in the UK and was considered the UK’s most valuable technology start-up for 2021.

The mobile application has made it very easy for the users while there is the possibility of issuing a card. One of the most basic features is the free exchange of currency, except for the weekend when the transactions are charged with an additional charge of 0.5% to 2%.

The number of users is about 18 million and over 500 thousand business owners use it. It is supported in over 35 countries, including the US, Australia and Japan, with at least 30 different currencies in place.

Revolut also provides Revolut for businesses. Opening a business account is easy, as long as you fill out an online form.

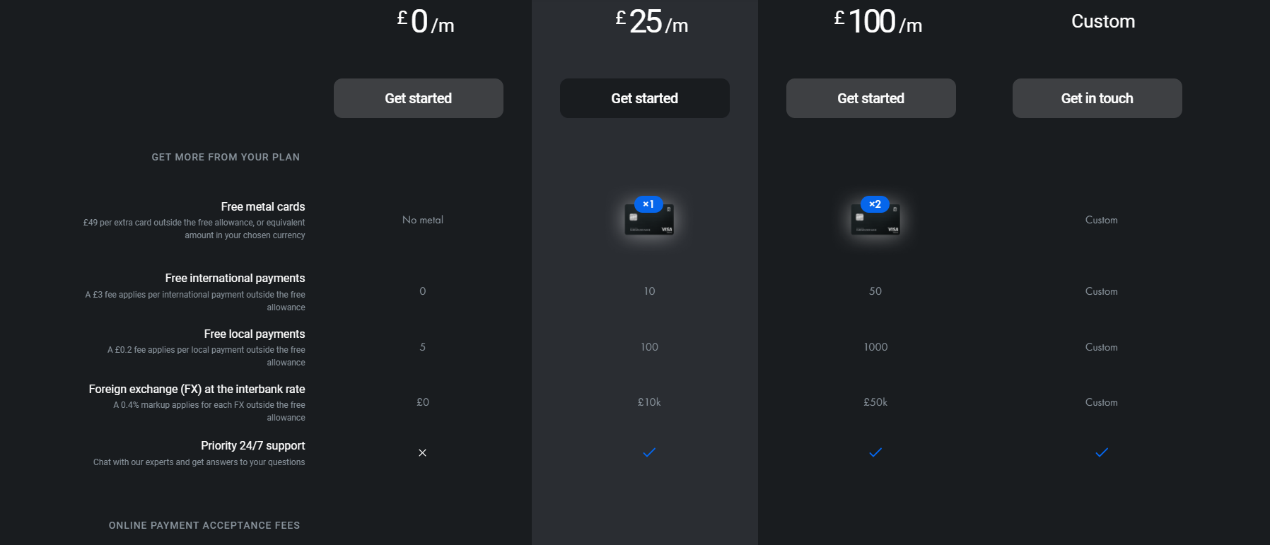

In the table below there are the plans that Revolut has as well as what they offer. Otherwise, this link refers to the entire website where one can find all the characteristics of each account plan.

Source: https://www.revolut.com/

The following video is a webinar as an Introduction to Revolut Business accounts:

Slovenia

Mobile wallets in Slovenia

Contactless payments with a mobile wallet are an alternative to plastic cards. Mobile wallets in Slovenia are offered by most banks, retailers and telecommunications companies in the framework of their own brand. For companies, this option is simple, fast and cheaper. Below you can find some of the most prominent mobile wallets in Slovenia:

mBills: https://www.mbills.si/

VALÚ: https://www.valu.si/

M Pay: https://www.mercator.si/aktualno/mobilna-denarnica-moj-m/

Mobile wallets of Slovenian banks (Meško, 2019)

Mobile wallets of fintech giants

There are many mobile wallets of various providers on the market that offer a wide range of different payment and other services. They constantly compete for market share and offer more and more innovative services. The most recognizable issuers of mobile wallets in the world are Google Pay, PayPal, Apple pay, Samsung Pay, Amazon Pay, Alipay, Facebook Pay, Venmo, Zelle, VeChat Pay etc. (Šuster, 2021, p. 52).

Based on the analysis of the user experience, the functionality and operation of the mobile wallet issued by a Slovenian bank were reviewed. Experiences of use are summarized below. Due to the increased number of digital challengers, the current situation is definitely not favourable for banks. On the top of that, they are confronted with regulatory changes and open banking, as well as with entirely new generation of customers that has increasingly higher expectations. Generation Z or digital nomads want fast and convenient services, available on mobile devices. To sum up, the simplicity of use of the mobile wallet application and the friendly user interface are important for a positive user experience. As these are services related to finance, this area doesn’t leave much room for error. Observed bank mobile wallet offers excellent and high-quality payment services, but at the same time less services that mean additional value to the customer in terms of organization and optimization of time, such as buying tickets, document storage etc. (Šuster, 2021, p. 66).

Ελληνικά

Ελληνικά Polski

Polski Română

Română Slovenščina

Slovenščina