Chapter 6: Shopping Behaviour and Social Shopping

Introduction

“Because the purpose of business is to create a customer, the business enterprise has two-and only two-basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”[1]

Why marketing? Because it is important for companies to fully understand consumer’s behaviour whether they are a person or an institutional buyer.

When we talk about the buyer’s behaviour is it good to understand how they decide? why do they prefer one place over another? How does increased access to information affect purchasing and spending choices? Delloitte’s answer refers, for example, to the three R’s – research, recommendations and returns – which may hold the key to consumer understanding.

Research

If we talk about research – it is based on digital technology that provides an unprecedented level of information. Here we can talk about influencers who may be completely unknown people but who can influence the purchase decision.

Recommendations and reviews

Recommendations and reviews on products, goods, services are increasingly sought after in the design of purchasing decisions.

Consumers are looking to gather information from

– Expert reviews

– User opinions

According to the EUROPE E-COMMERCE REPORT 2021 Customer reviews are, for an “important source of feedback, a trust enhancing mechanism, and a source of information for (potential) customers.

Within EU,

- 59% of e-stores offer customers the opportunity to write

- product reviews, and

- 23% provide consumers the option to review the company itself.

Returns

The possibility of return is an element that encourages the consumer to buy because one knows that within a certain time, they can return the product without penalty or with a small penalty. In this case, remorse, dissatisfaction, poor evaluation of the product before purchase are good reasons for returns.

The aim of this chapter is to understand the consumer behaviour as an important issue for effective marketing, helping managers to make selling decisions.

Learning objectives:

- To place consumption in the context of human behaviour

- To identify consumer behaviour in the context of the evolution of the online shopping and social shopping

Buyer, customer, or consumer are three almost similar expressions and are treated as such:

Buyer[2] – a person who has charge of the selection, purchasing, pricing, and display of the merchandise of a retail store

Customer[3] – a person who buys a product or uses a service from a business

Consumer[4] – a person who buys goods and services

What do these people have in common:

Search for:

– Sources of product information?

-Ways to evaluate alternative products (opinions, reviews, social media, influencers)

– Information about other users (experiences)

It is informed / analysed:

– What is the value for money of the product

– What are the risks of purchasing the product / service

– What influences the purchase decision?

On the other hand, B2C aim to find out:

– Who / what influences the decision to buy or use a product

– How is brand loyalty formed and changed?

– What are the internal factors that affect the purchase decision (psychological, personal, social)

To summarise, a typical definition of consumer behaviour might be the following:

- The mental, emotional and physical activities that people engage in when selecting, purchasing, using and disposing of products and services so as to satisfy needs and desires.[5]

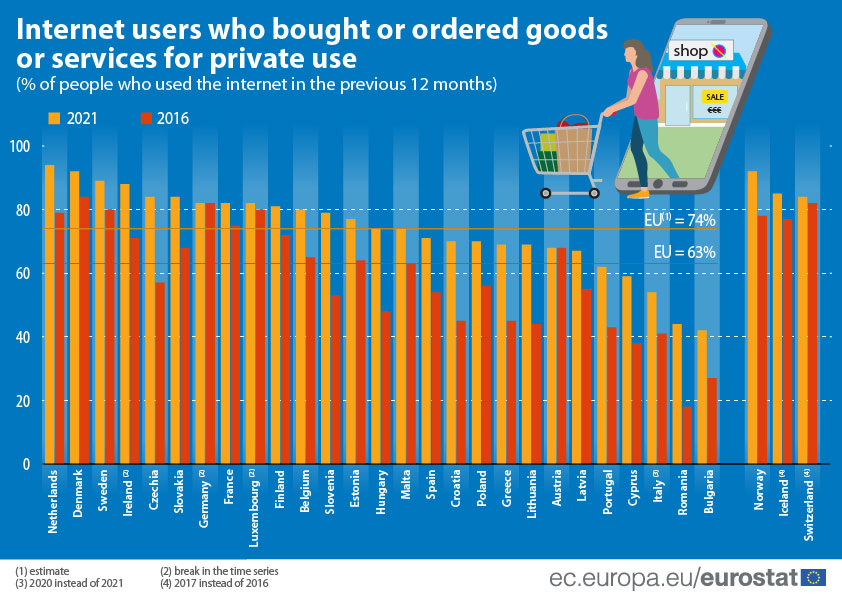

According to Eurostat[6] 74 % of internet users in the EU shopped online in 2021 and 42 % of e-buyers made purchases for an amount between 100 to less than €500 in the last 3 months prior to the Eurostat survey.

Consumer behaviour types

We all are consumers hence consumer behaviour is an integral part of our daily lives. But we are not all the same and psychological and social processes involved in buying and consuming goods and services make the difference.

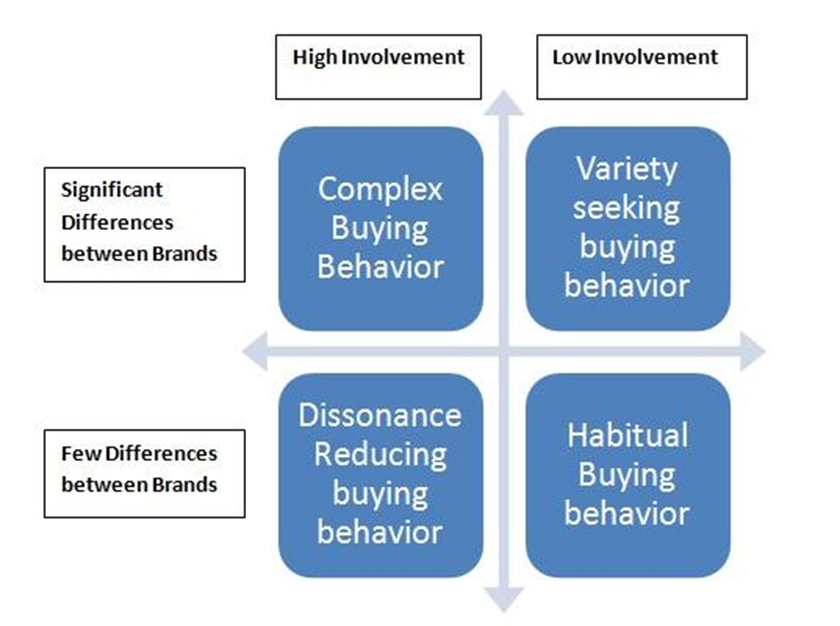

The literature recognizes four types of consumer behaviour:

Figure 3 Source: https://clootrack.com/knowledge_base/types-of-consumer-behavior/

- Complex buying behaviour – Buying something very expensive such as a house or a fancy car. People in this situation

- make in depth research before the purchase decision,

- look for advice (family, friends, specialists)

- inform themselves from multiple sources,

- search online for the market offer and look for alternatives, pros, and cons

- Dissonance-reducing buying behaviour – buying infrequent a good or a service. Because of a low availability of choices with less significance differences among brands and prices, consumer do not have many choices and lot of research is not necessary for purchase decision.

Some characteristics:

- Infrequent purchases

- Low availability of choices

- Limited decision making

- Time limitations

- Budget limitations

- Habitual buying behaviour – is daily buying for each customer. It does not include too much thinking it is more about the attitude.

For example, while a consumer buy bottled water, he always tends to buy the familiar brand without a lot of research and time investment. He knows the product and like it.

- Variety seeking buying behaviour

The buyer from this category enjoys changing own buying decision as there is plenty of brands on the market and there are low costs to make the decision.

For example, the consumer buys a certain bottled water one day and change it next day to try something new.

More about consumer behaviour types you can have a look to the YouTube: Steven Fob[7] – Four Types of Buying Behaviour https://www.youtube.com/watch?v=Bnrdv-7ndFo

What is social shopping?

Well, social shopping can be seen as an adventure of buying things combining e-commerce with social media, allowing people to buy directly on different platforms like Facebook, Instagram and Tik Tok.

The importance of social shopping is a two-way road. One the one hand there is a huge consumer bases that can buy easy via social media platforms and on the other hand companies can put their storefront directly on the platforms.

According to the 2021 European E-commerce Report[8] :

- 93% of the European web shops display their social media channels on their website

- The most popular media channels used by online stores are Facebook, Instagram, and YouTube

- Less frequently used social media platforms are Tumblr, Snapchat and

TikTok.

- Web shops from Northern Europe have fewer Pinterest (8%), YouTube (55%) and Instagram (69%) accounts on their website.

- Additionally, Twitter is much more popular among e-stores in Western Europe (71%) and Southern Europe (53%), compared to Northern Europe (24%) and Eastern Europe (26%)

According to the same report the most preferred use of contact options in EU 27 are:

- Phone call = 90%

- E-mail = 74%

- Contact form = 66%

- Chat = 47%

- Instant messaging/VOIP = 11%

- Fax = 8%

Knowing the preferred contact options of consumers help web shops to design proper communication channels to rich consumers.

Figure 4 Source: EUROPE E-COMMERCE REPORT 2021

All these information shows that selling through social media channels is onnected to disruptive B2B, and B2C techniques.

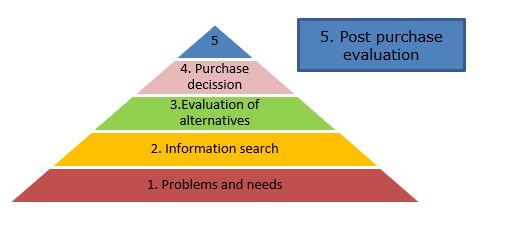

Starting from the 5 Stages of the Consumer Decision-Making Process[9], let’s see how they changed.

- Need identification – is the point at which the consumer identifies the problem, need or desire. It is an area quite little used by companies that, at this moment, could create the need and use every channel to get customers to their products. The need identified is linked very close to the point 5 post purchase evaluation.

Moreover, for the B2B or B2C it is strongly important to answer two questions:

- What problem your product or service solve?

- Is it easy enough for customers to find your brand using normal search engines?

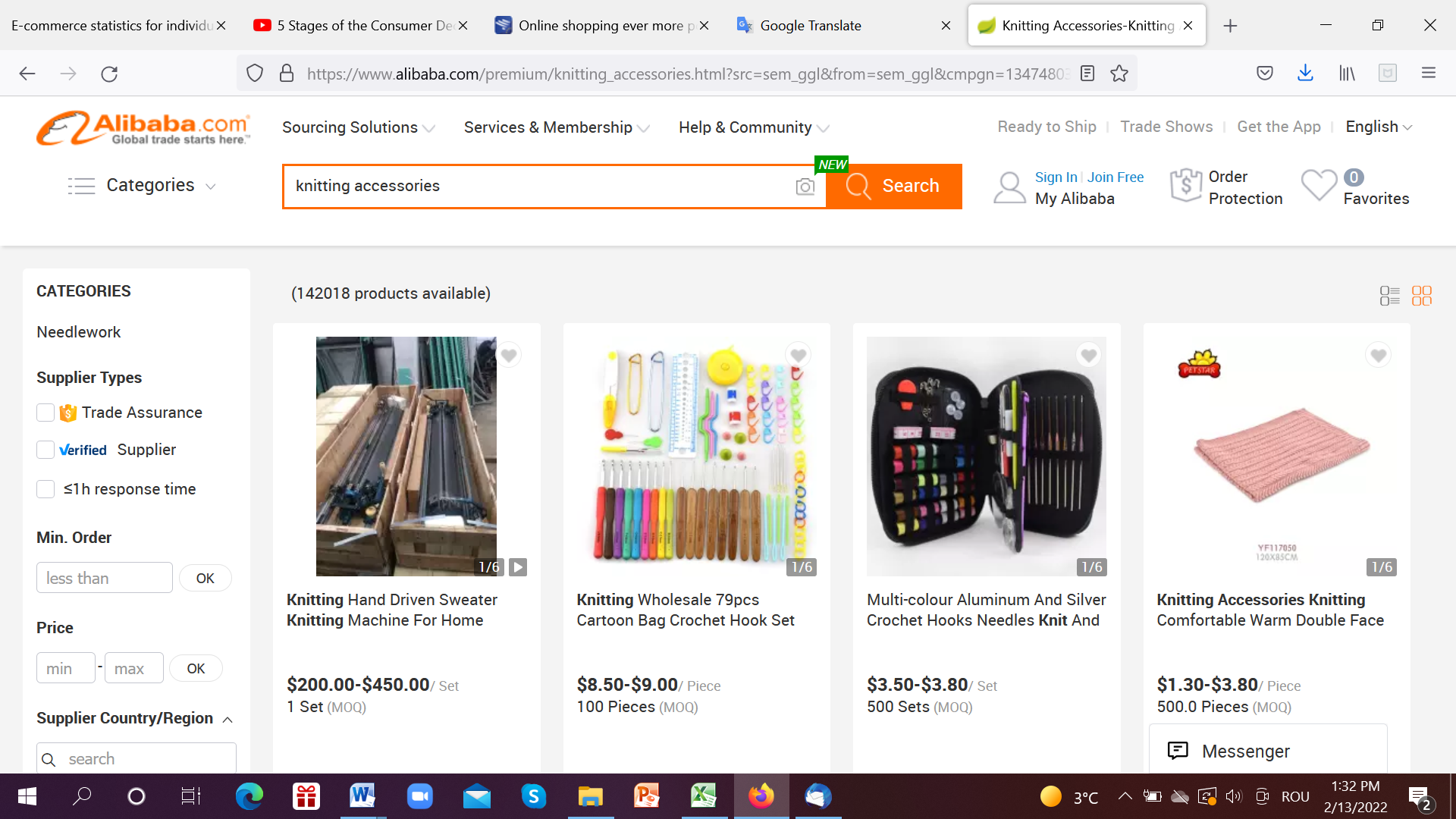

Example: You are a knitting accessories vendor, and COVID 19th kept people in the house. So many people have tried to spend their time with various hobbies, one of them being knitting. So, in a simple search it appears, and obviously many more

In our case, the first three that appeared are: Alibaba, Made in China, Amazon.de

Figure 5 Website visited 13.02.2022

- Information search – years ago, buyers did not have many sources of information about certain products or services they needed. Therefore, they used family and relatives as a resource, newspapers, TV networks, and a daddy. Today, the multitude of information around us is possible thanks to the Internet, electronic applications, social networks, and much more. For B2C it is a great opportunity and a need to provide information that helps potential customers get informed.

The question buyers want to answer to is, If I need a product from which place will I buy it, who will offer me what I need?

For B2C and B2B is very important to answer this question. If they manage to do so, here is the point where the revenue is coming for the company.

- Evaluation of alternatives – people are very interested to find and buy the best from the alternatives they have. At this point they will not look to your website, your apps, but they will check against other people recommendations and reviews. The research companies are providing information to customers and companies need to be part of this process because you do not control anymore what other people think about your product, but other people control that.

- The purchase decision – having in mind consumer behaviour that is different based on buyer models. Here some examples:

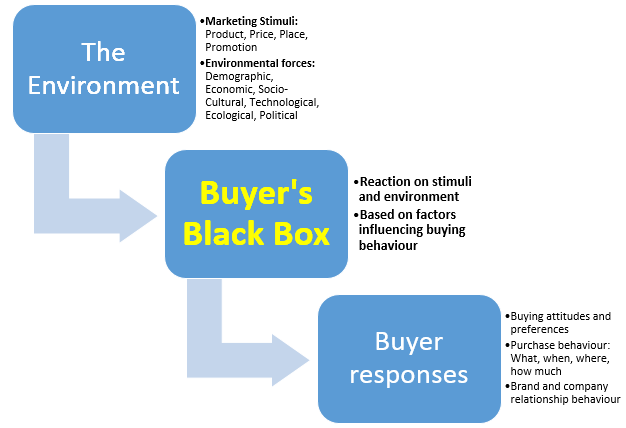

Figure 6 Source: https://marketing-insider.eu/buyer-black-box/

The buyer`s decision is influenced by cultural, social, psychological factors that cannot be easy influenced but B2B or B2C need to know them.

They are:

| Cultural factors | Social | Personal | Psychological |

| Culture

Subculture Social class |

Social networks

Small groups Family Role & status |

Age and lifetime stage

Occupation Economic situation |

Motivation

Perception Learning, memory and thinking Beliefs& attitude |

Figure 7 Source: Marketing Insider, 2019 https://marketing-insider.eu/buyer-black-box/

- Post purchase evaluation – when speaking about purchase evaluation, as always, not all customers are happy with the goods or services bought. Return possibility encourage buying. At this stage B2B and B2C need to gather as much feedback as possible to realize what is wrong and to improve the situation.

Theoretical part – GREECE

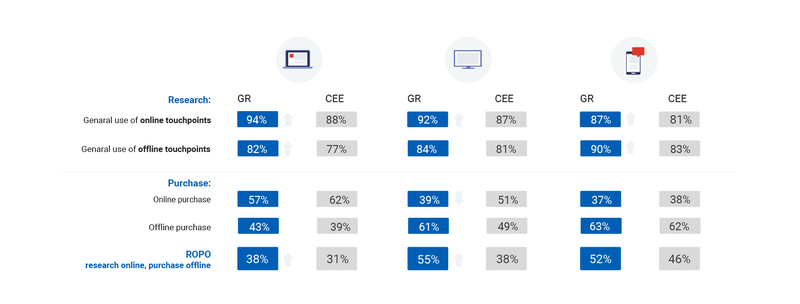

Consumers in Greece take time to search and use more interfaces than shoppers across the CEE region. IPSOS and Google CEE1 polled 4,500 customers about a variety of items and services, including notebook computers, televisions, and mobile phone contracts.

Greek customers, in comparison to their regional counterparts, spend more time searching across interfaces and prefer to make offline purchases. Between 25% and 40% of Greek customers did not have a specific brand in mind at the start of the purchasing process. The fact is that many customers aren’t loyal to brands; rather they are devoted to products and services that make the most sense to them at the moment of decision making. Greek consumers are more ready to do in-depth research across both online interfaces and physical stores. They use more interfaces and search through them so much more frequently than their regional counterparts.

Figure 8 Source: Protasiuk, 2019

Greeks are careful bargain seekers who spend their time searching price comparison websites, product specifications pages, while looking for ideas. The majority of customers are comparing costs and looking for specials, but a sizable percentage are seeking for inspiration and what’s on the market (Protasiuk, 2019).

As far as COVID-19 period is concerned, Greeks have slightly altered their shopping habits. The findings of the Future Consumer Index Greece 2021 survey clearly show that individuals are not merely consuming more items and services at home. Their entire lives are being rebuilt around their homes.

Consumers in Greece are most concerned about the economic impact of the pandemic. As a result, individuals prefer to spend less today, purchasing only what is absolutely necessary and saving more. Over the next three years, this tendency is unlikely to change. By far the most important purchase factor will remain price. Greeks will continue to spend the same amount on most things as they did during the pandemic, and in the few cases where they will modify their spending, it will be primarily downward. Many customers indicate they are willing to pay more for products that have unique features. Items made in Greece, high-quality products, and products that offer comfort, practicality, and convenience are among them. Consumers’ willingness to pay a premium for a product, on the other hand, differs significantly between demographic groups (Mavros, 2021).

Social Shopping in Greece.

Social commerce services, such as the Commerce Manager of Facebook for sales on Facebook and Instagram, are currently not available in Greece (Synergic, 2020).

According to a NielsenIQ survey of 850 Greeks online last September-October, 6 out of 10 said they had already bought from online shops, through social media platforms, with new age groups remaining the main driver of the channel. Facebook remains the most popular platform for buying goods on social networks, with 52% of online shoppers in Greece using it for this purpose. It is followed by Instagram, which is preferred by the younger generation (18-24 years old) – with almost half (49%) of respondents in this group saying that they use Instagram for online shopping.

Figure 9 Source: Synergic, 2020

The rise of social commerce is associated with an increase in the use of social media and the average time that some people spend on them. In Greece, 7 out of 10 Greeks said that they increased the time they spent on social media from the start of the lockdown from last March until today (Gkitsi, 2021). The growing amount of time most people, especially the younger generations, are devoting to social media applications has made social commerce an undisputed trend for e-commerce in the upcoming years. Equally important is the emerging preference of young users on social networking platforms with video and photos as the main content. This fact is confirmed by the significant percentage of young people moving from Facebook to platforms such as ΥouΤube, Ιnstagram and Snapchat. This is a very important parameter that companies should include in the preparation of their marketing strategy for the upcoming years (Synergic, 2020).

References

Protasiuk, M. (2019). Particularly greek: The modern path to purchase in Greece. Google. Retrieved February 10, 2022, from https://www.thinkwithgoogle.com/intl/en-cee/consumer-insights/consumer-journey/particularly-greek-modern-path-purchase-greece/

Mavros, T. (2021, June 10). As Greek consumers keep adapting, how ready is your business to respond? EY US – Home. Retrieved February 10, 2022, from https://www.ey.com/en_gr/future-consumer-index/as-greek-consumers-keep-adapting-how-ready-is-your-business-to-respond

Synergic. (2020, April 1). To Ηλεκτρονικό Εμπόριο σήμερα, eCommerce trends. (The E-Commerce today. E-Commerce Trends) Retrieved February 10, 2022, from https://synergic.gr/el/ilektroniko-emporio-ecommerce-b2b-b2c

Gkitsi, A. (2021). Ξεχάστε τα eshops, ζήτω το Social Commerce. (Forget eshops, long live Social Commerce) Capital.gr. Retrieved February 10, 2022, from

https://www.capital.gr/epixeiriseis/3526791/xexaste-ta-eshops-zito-to-social-commerce

Theoretical part – ROMANIA

According to Eurostat (2021), the highest shares of internet users who bought or ordered goods or services over the internet in the 12 months prior to the survey were recorded in the Netherlands (94%), Denmark (92%) and Sweden (89%). On the other hand, fewer than 50% had shopped online in Romania (45%) and Bulgaria (42%).

Based on the EUROPE E-COMMERCE REPORT 2021,

- Romania growth rate (B2C) is 30% compared with GR -77%,

- Romania e-GDP 3,51% compared with GR 6,65% and Denmark 7,29%

- FREQUENCY OF ONLINE PURCHASES IN THE LAST THREE MONTHS, 2020, Romania –

- 2% six times or more

- 10% 3to 5 times

- 14% 1-2 times

- ONLINE PURCHASING NATIONALLY AND CROSS-BORDER, THREE MONTHS, 2020

- From national sellers = 97%

- From sellers from other EU countries=10 %

- From sellers of the rest of the world (non-EU countries) = 4%

- From sellers from unknown countries =2%

- From sellers from other countries (EU or non-EU) =1,2%

There is a clear approach based on Romanian customer behaviour. Year 2020 was the first year of severe COVID 19 restrictions and customers started buying online because of the less brick and mortar shopping, restricted almost all the year.

Estimates, for the e-commerce sector – it exceeded the 5.6-billion-euro threshold at the end of 2020, 30% more than in 2019 when the value of e-commerce was estimated at 4.3 billion euro[10]. The transactions generated in represents the e-tail segment only, and does not include services, utility bills, digital content or plane tickets, vacations & travel, hotel reservations, show tickets or other events. Food was one of the most important buying and Food Panda was the star.

However, when discussing the behaviour of the Romanian buyer, we must also take into account the way he pays. The Romanian buyer feels the most compliant when he pays the moment, he receives the products. The pandemic has a massive effect on cash usage in Romania[11]. “The number of people paying physical money decreased from 45% to 21%. Meanwhile, the popularity of contactless cards reached 59%. “But the Romanian consumer still feels secure to pay « Cash-on-delivery »

The reasons for this behaviour can be[12]

- It is more convenient = 59,6%

- Had no other available way=42,5%

- It is safe=28,3%

- “True online commerce” also means electronic transactions=25,9%

- Other =2,4%

Customer behaviour in Romania is changing. While last year the development of e-commerce projects came from the fashion industry, followed by the electrical IT and DIY industries, the biggest increases in the current year are likely to be reported by industries such as retail and distribution, logistics and transport, technology, but also health.

References

Understanding consumer behaviour, from the inside out, https://www.youtube.com/watch?v=XowaDm1GEVk

Understanding consumer behavior, consumer behavior definition, basics, and best practices:

https://www.youtube.com/watch?v=jP3XVgrSNsM

CHAPTER 1 – What is Consumer Behavior, https://www.youtube.com/watch?v=gtfPU6nTa9k

Consumer Behavior with Michael Solomon:

https://www.youtube.com/watch?v=TfK6nawMEp0

Stages of the Consumer Decision-Making Process and How it’s Changed https://www.youtube.com/watch?v=a9lpVg54u-k

The Buyer Black Box – Buyer’s Characteristics – Factors influencing the Consumer Buying Behaviour https://marketing-insider.eu/buyer-black-box/ visited 13.02.2022

Steven Hob Four Types of Buying Behaviour:

https://www.youtube.com/watch?v=Bnrdv-7ndFo, 13.02.2022

Live Shopping, Direct-to-Consumer și comerțul conversațional, printre cele mai importante tendințe în e-commerce în 2022 – Roxana Vasile:

Theoretical part – POLAND

Social selling will certainly develop at a very fast pace in the coming years. This is undoubtedly a new trend that has accelerated, among others, as a result of the Covid-19 pandemic. The majority, as many as 86% of buyers, are satisfied with the transactions made so far, and more than half of them declare that they will repeat purchases in this form in the near future.

According to the report: “The power of social & live commerce report”, carried out in 2021 by the Foundation of e-business women, it was shown that 27% of Poles make purchases via social media. Every fourth Pole made a purchase in the process live broadcasts in social media, including 10% often shop like this. It is estimated that 18% of Poles sell on social media.

It follows that it is worth considering this method of sale when thinking about entering the Polish market, targeting Polish consumers.

Who buys and sells on social media the most? Mainly young women up to 34 years of age from smaller towns and villages. Therefore, messages and products should primarily be addressed to them.

Where do transactions most often take place? Through Facebook.

What do Poles most often buy via social media? The most popular industries thanks to which social commerce in Poland is growing in strength are: clothing and footwear (which 45% of Poles bought through social media, and 41% have experience with selling this assortment in this channel), books, CDs and films (respectively: 27% and 23%), cosmetics / perfumes (27% and 18%) and children’s goods and toys (24% and 17%).

And what discourages you from buying or selling via social media? Shopping habits related to the choice of stationary stores, the possibility of touching or seeing a given product live. An important deterrent is the concern about the security and quality of transactions (fraud, problems with complaints, etc.).

Why do Poles decide to shop through social media? Because they consider this solution to be simple, quick and convenient, personalized (well-suited to current needs), and in addition, allowing you to choose a favourable price, thus affecting savings.

Purchases made during the so-called Live broadcasts attract Polish customers more and more often, attracting interest in terms of form and price, but most of all they engage emotionally. It is a form of shopping liked by consumers (42%) and simply addictive (according to 39%). Therefore, it is good to consider introducing this type of product or service presentation.

How do Poles like to buy? Preferably on social media by contacting the seller directly or by clicking on links redirecting to sales platforms and e-shops. That is why it is worth carrying out activities in accordance with the principles of systematic and reliable communication via instant messaging, as well as ensuring the quality of the page to which the redirection from social media will lead.

How often do Poles buy? We have been buying for at least 2-3 years (39%), at least once a month (47%), mainly by smartphone. Therefore, one should remember about appropriate responsiveness and matching of messages to smartphones in terms of technology and frequency, expecting that regular customers will buy from us once a month.

How much is a standard Pole able to spend on a one-off transaction concluded via social media? On average, such purchases are spent between PLN 50 and PLN 200 (41%). It is an important hint when pricing individual products and services.

Attention! Poles most willingly and most often pay with BLIK in such transactions, it is necessary to remember about it, or to profitable sales to Polish customers. Without the possibility of using the BLIK payment option, it is very likely that a potential customer will change his mind, believing that a standard transfer takes too much time.

You should also remember about the form of shipping. Many Poles prefer to ship to parcel machines, at an affordable price around PLN 8 or cheaper. Too demanding commitment to collection or an expensive shipment may turn out to be a “deterrent” and discourage a potential customer from purchasing.

A few words about sales in the style of social selling in Poland from Polish sellers.

Why is it worth considering this form of sale in Poland? Because it is cheap and easy for the seller, and in addition it allows you to better reach the target group.

How is it sold most often? For example, by inserting photos of products / services with a description or a post informative. Polish sellers willingly use Facebook Marketplace, Instagram Shop and external advertising and auction portals.

How to most effectively reach potential customers? The most frequently used for this are promoted posts and word of mouth marketing, i.e., a system of recommendations and recommendations from friends.

What kind of sales effect can you expect? On average, up to 10 transactions / month are carried out, so income from sales via social media is a more additional source income than a way to earn regular earnings – the most common average monthly income from sales via social media is no more than PLN 1,000 (31%). However, taking into account how this form of sales is developing and the fact that the sales technique itself is easy and fast and reaches potential customers, it is worth using it.

The key challenge is strong competition, and therefore effective promotion of the store / seller in order to better reach the customer.

The most popular social networking site through which Poles make purchases or sales is Facebook. Slightly over 80% of people who buy or sell via social commerce use this website for these purposes. Competitive portals are far behind, although they also have their supporters. Apart from Facebook, social commerce is also visible on Instagram and YouTube. Poles spontaneously include social networking sites such as Vinted, OLX or Allegro. Few Poles, however, make purchases on TikTok, Snapchat or Pinterest (about 7%, and 82% from Facebook).

What to remember when designing a promotional strategy in social media in Poland?

Social media is an integral part of the life of many Poles, which certainly favors the development of social selling in this country. As many as 71% of respondents have been using social networking sites for at least 5 years, using them practically around the clock – from early morning to late evening hours. This shows that social media has settled in for good in our lives, filling every “slower” moment of the day.

Social networking sites are most often visited in the evening – between 6.00 p.m. and 10.00 p.m. – every second respondent (53%) most often uses social media during these hours, which may show that they are treated as “entertainment” / relaxation after the whole day, as well as checking what is happening with our friends or people we follow.

The above conclusions quite well illustrate how strong the potential of social commerce can be and how effective this sales channel can turn out to be – since we have been using social networking sites continuously for several years, all day long, it is a chance / temptation to make fast, adapted to our needs and shopping preferences, which are done “while browsing” the portal, is quite high.

References

Social Media w Polsce 2021 – raport, https://empemedia.pl/social-media-w-polsce-2021-nowy-raport/

Social Media jako platforma e-commerce. Nowy raport the power of social & live commerce. https://www.kobietyebiznesu.pl/social-media-jako-platforma-e-commerce-nowy-raport-the-power-of-social-live-commerce/

The power of social & live commerce https://www.przelewy24.pl/dla-mediow/social-media-jako-platforma-e-commerce-raport-power-social-live-commerce

https://socialpress.pl/kategoria/raporty

Theoretical part – SCOTLAND

The United Kingdom is a mass consumer society, even though ecological and responsible consumption is growing, and ethical and environmental business practices are becoming increasingly important Especially after the pandemic and the restrictions, the e commerce is becoming a very important market. 6 out of 10 British pay attention to the product origins (Export Entreprises SA, 2022).

Only in 2020, 6 in 10 British consumers had bought at least one garment online in the last 12 months, making clothes their first choice. Then follow electronic items, cosmetics etc. (D. Tighe, 2021)

Before making a purchase, over 60% of shoppers look for the product or similar product online by reading reviews from previous customers.

90% also stated that they usually avoided buying from a company with a 4-star rating, making it vital for e-retailers to provide quality products and customer-friendly services. (D. Tighe, 2021)

Of course, the pandemic had a significant impact on world trade. In the UK, 70 per cent of British respondents said their online shopping had increased compared to before the pandemic. Even before the pandemic, e-shopping in Britain, mainly in electronics, was in high numbers. The main area in which change was observed was the purchase of clothes with 28% more consumers preferring to buy clothes electronically, compared to the period before the pandemic (Justine L’Estrange, Emily Allen, 2021). At the same time, the age range of online shopping has increased. Of course, the pandemic did not completely change the way they choose to shop. As can be seen in the table below, for example in the field of beauty, the pandemic does not take high positions in the ranking. Also, the same research conducted in collaboration with Google and Trinity McQueen shows that at this time, even at a young age, a hybrid shopping model is preferred. (Justine L’Estrange, Emily Allen, 2021)

For marketers:

- The above data show that even if retail is a priority, the image of a business on the internet is very important and in no case should be neglected (Justine L’Estrange, Emily Allen, 2021).

- Be competitive on price. 35% of costumers in the UK use comparison sites for this purpose (WordBank).

- Build loyalty. 65% of UK consumers claim to be loyal shoppers – above the global average of 61%. Loyalty programs are also popular. 73% of 18-24-year-olds in Britain think they’re a good way for brands to reward customers (WordBank).

- Focus on the lifestyle aspect of the brand (WordBank).

Figure 10 The shift in shopping: The data that reveals the permanent changes to U.K. consumer behaviour, Justine L’Estrange, Emily Allen

Social Shopping

Purchases through social media are increasing in the United Kingdom. Nearly a quarter of shoppers in the UK use social media to discover new products, according to US-based software company Bazaarvoice’s 2021 annual shopper experience. (Jessica Paige, May 6,2021). Social shopping takes place mainly through Instagram, Facebook, Pinterest, Snapchat and Tik Tok. However, it is important to recognize that social commerce is aimed at younger consumers, especially among Generation-Zs, i.e., people aged 25 and under.

Based on the findings of the above research, 43% of ages 18-24 and 47% of ages 25-34 choose to look for new products through social media. 33% even go ahead with the purchase of products. (Jessica Paige, May 6,2021)

When asked about product sampling, 87% of respondents in the UK said they would like to receive free samples, 51% said they would be willing to write a review for free products and 28% said they would post about it. product on social media. (Jessica Paige, May 6,2021)

By allowing the customer to cash in directly through social media platforms, social commerce removes unnecessary steps and streamlines the buying process. Also, many websites do not have a mobile version, so it is difficult for the consumer to navigate the website and not make a final purchase, unlike the social media platforms that have been built to be mobile friendly (BigCommerce).

Also with canonical markets, marketers target a much wider audience and therefore require a careful business presence on social media.

References

Social Commerce: How Social Shopping Can Drive Sales (2022). (n.d.). BigCommerce. https://www.bigcommerce.com/articles/omnichannel-retail/social-commerce/

Paige, J. (2021, May 6). UK shoppers turn to social media to discover and buy new products. Retail Insight Network. https://www.retail-insight-network.com/features/uk-shoppers-turn-to-social-media-to-discover-and-buy-new-products/

Lingo, M. (2020, January 31). UK Consumer Behavior: What Do The British Want? | Wordbank. Wordbank LLC. https://www.wordbank.com/us/blog/market-insights/uk-consumer-behavior/

Gu, S. (n.d.). Impact of the COVID-19 Pandemic on Online Consumer Purchasing Behavior. MDPI. https://www.mdpi.com/0718-1876/16/6/125

Export Enterprises – International Trade Tech Solutions. (n.d.). https://www.export-entreprises.com/

Sustainability & Consumer Behaviour 2022. (n.d.). Deloitte United Kingdom. https://www2.deloitte.com/uk/en/pages/consumer-business/articles/sustainable-consumer.html

Theoretical part – SLOVENIA

Last year, the shopping behaviour of most consumers was focused on the internet, as according to Statistical Office of the Republic of Slovenia. In the first quarter of 2021 as many as 59% of consumers aged 16 to 74 shopped online and were thereby leading to increasing normalization of online shopping. But what has kept consumers online and what can we expect in the coming years? It seems that consumers are turning to online shopping not only out of necessity and convenience, but also or perhaps because of the safe environment in the face of the pandemic (Polanec, 2022).

The recent Shopper’s Mind 2021 study, conducted by a consortium of partners Valicon, iPROM and Ceneje.si, shows that the growth trend in online shopping continues. In Slovenia, online shopping is becoming more frequent and more intensive. Most purchases are recorded in the categories of fashion, electronics, home and garden, and the average value of the purchase is almost 100 euros. 73% of Slovenians make four online purchases per year, with just under half of those who shop regularly using a smartphone and debit cards most often. The age structure of online customers has not changed in the last three years (2019-2021). Representatives of Generation X (44%) and Z (33%) are among the most numerous online customers.

A comparison of purchases between domestic and foreign online shops shows that the vast majority of customers shop in domestic shops (84%, the average purchase value is 102 euros), while 16% of online purchases are made in foreign online shops (the average purchase value is 56 euros).

Among the most frequently used means of payment in the last three years, cards of all kinds predominate in 2021 (55%), followed by cash (29%) and payment by proforma invoice (13%). A comparison between generations shows that generations Z, Y and X are more likely to prefer card payments than the baby boomer generation, but these differences have narrowed slightly over the past two years.

In the last two years, online shoppers have most frequently made purchases via smartphones (with the help of which as many as 55% of purchases were made in 2021). Computers (laptops and desktops) are still important – 38% of online shoppers make their purchases via laptops and 32% via desktops. A good third of online purchases are completed by consumers via mobile phones (38%), just under a third via laptops (31%) and a good quarter (26%) via desktop computers (Guest author, 2021).

References

Guest author. (2021). Nova raziskava Shopper’s Mind 2021: Spletni kupci v Sloveniji nakupujejo vse pogosteje. Shopper’s Mind. https://smind.si/nova-raziskava-shoppers-mind-2021-spletni-kupci-v-sloveniji-nakupujejo-vse-pogosteje/

Nabernik, N. (2021). SLOVENSKI INFLUENCERJI: KDO SO NAJVPLIVNEJŠI INFLUENCERJI V SLOVENIJI? Omisli.si. https://omisli.si/nasvet-strokovnjaka/influencer-marketing/slovenski-influencerji-kdo-so-najvplivnejsi-influencerji-v-sloveniji/

PJU. (2022). Kako s pomočjo influencer marketinga povečati prodajo? INFLUENCER MARKETING V PRAKSI: STUDY CASE KAMPANJE ZA BREZŽIČNE SLUŠALKE 2019. PJU. https://pju.si/

Polanec, M. (2022). Slovenci so v 2021 na spletu najraje kupovali mobilne telefone in pnevmatike. Shopper’s Mind. https://smind.si/slovenci-v-2021-na-spletu-najraje-kupovali-mobilne-telefone-pnevmatike/

[1] https://www.forbes.com/2006/06/30/jack-trout-on-marketing-cx_jt_0703drucker.html?sh=431fad76555c visit 06.02.2022

[2] “Buyer.” Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/buyer. Accessed 7 Feb. 2022.

[3] “Customer.” Merriam-Webster.com Thesaurus, Merriam-Webster, https://www.merriam-webster.com/thesaurus/customer. Accessed 7 Feb. 2022.

[4] “Consumer.” Merriam-Webster.com Thesaurus, Merriam-Webster, https://www.merriam-webster.com/thesaurus/consumer. Accessed 7 Feb. 2022.

[5] Edinburgh Business School – Consumer Behaviour Jane Priest, Stephen Carter, David A. Statt

[6] https://ec.europa.eu/eurostat/statistics-explained/index.php?title=E-commerce_statistics_for_individuals#General_overview

[7] Steven Hob Four Types of Buying Behaviour https://www.youtube.com/watch?v=Bnrdv-7ndFo visited 13.02.2022

[8] https://ecommerce-europe.eu/wp-content/uploads/2021/09/2021-European-E-commerce-Report-LIGHT-VERSION.pdf

[9] 5 Stages of the Consumer Decision-Making Process and How it’s Changed https://www.youtube.com/watch?v=a9lpVg54u-k

[10] https://www.gpec.ro/blog/en/gpec-romanian-e-commerce-2020-report-5-6-billion-euro-worth-of-online-shopping-a-30-yoy-growth

[11] https://ecommercenews.eu/popular-payment-methods-in-europe-in-2022/

[12] Romanian Consumer Behaviour and Payment Choice

in Online Shopping. A Marketing Perspective

Mihaela CONSTANTINESCU*, Andreea ORINDARU, Daniela IONIȚĂ, Ștefan-Claudiu CĂESCU, DOI: 10.2478/9788366675162-006

Ελληνικά

Ελληνικά Polski

Polski Română

Română Slovenščina

Slovenščina