Chapter 2: Digital tax systems in Europe

Introduction

Digitalization of the taxes is quite common in the European Union. Many countries of our Union provide those solutions for companies and citizens.

In this chapter, the consortium of the DigiER project will introduce to the readers the e-tax solutions which are provided for the companies in the countries of the partnership:

- Greece.

- Poland.

- Romania.

- Scotland.

- Slovenia.

Theoretical part – GREECE

What is TAXISnet

TAXISnet is an information system with which taxpayers and businesses make transactions with the General Secretariat of Information Systems (GSIS), bypassing the public financial service (READER, 2017). It was developed in 1997, by the newly formed GSIS. TAXISnet target is to facilitate taxpayers to settle their tax obligations more easily, faster, and more correctly (GRAVIAS, 2010). With its creation, TAXISnet managed to modernize the Greek tax system, upgrade the information of the citizens, reduce the bureaucracy and serve the user directly with its 24-hour operation.

TAXISnet services

The taxpayer can file an income tax return (Ε1, Ε2, Ε3, Ε9, Ε14). TAXISnet provides the possibility of submitting a clearing declaration (F1), periodic declaration (F2, F3) as well as intra-Community delivery-acquisition forms. The system has withholding tax applications with the Tax Return & Stamp Fee Declaration and the Employee Services Tax Return. For the Code of Data and Books the taxpayer can send electronically the status of Customers-Suppliers, the credit balances of Customers-Suppliers, the transfer of the Electronic Tax Mechanism and the submission of Notifications. In the system the interested parties can print the traffic fees of their vehicles. In recent years TAXISnet has been upgraded, offering the ability to pay debts using a credit card or bank account, providing access to bonus services, enabling the submission of a real estate lease, and providing the possibility of changing personal data without the need to resort to the tax office (EFM, 2017).

From October 2019 the services of the municipalities have access to TAXISnet. This means that the departments of the municipality will have the data of the citizen without the need for the latter to provide them (KARAPAPAS, 2019). At the same time, the taxpayer may receive notifications of payment or refund of tax, be informed about the settlement of their tax return and in addition make tax awareness receipts. In addition, TAXISnet allows the printing of tax forms, thus making the system an electronic tax file for the citizen.

The advantages of TAXISnet

The main advantages for the citizen are the reduction of travel since it is not necessary to visit a tax office for numerous services, the simplification of procedures as well as the settlement and delimitation of their relationship with their accountant in case they choose a professional to take over settlement of its tax liabilities (GRAVIAS, 2010). Additionally, registration process is quite easy, as it requires three simple steps (online application, key number receipt & username and password setting).

The new era

Since September 2021, TAXISnet was replaced by the Independent Public Revenue Authority (AADE). The new digital portal provides more than 250 digital transactions with a much more friendly environment for both taxpayers and accountants. As it was pointed out, the digital services of AADE are estimated to lead to savings of 2 million hours per year (CNN, 2021).

References

Aade.gr – ΑΑΔΕ. (n.d.). Retrieved February 8, 2022, from https://www.aade.gr/

CNN (2021, September 16). CNN. Τέλος το “taxisnet” – στη θέση του το “myaade“. (No more “taxisnet” – in its place is “myaade“.) CNN.gr. Retrieved February 4, 2022, from https://www.cnn.gr/oikonomia/story/281710/telos-to-taxisnet-sti-thesi-toy-to-myaade

EFM. (2017, March 10). EFM. GSIS – taxisnet – όσα χρειάζεται να ξέρετε πριν μπείτε. (GSIS – taxisnet – what you need to know before entering). Retrieved February 4, 2022, from https://efm.gr/gsis-taxisnet-plirofories-eggrafis/

Gravias, K. (2010). Taxheaven. Το νέο taxisnet είναι πλέον γεγονός. (Taxheaven. The new taxisnet is now a fact) Retrieved February 4, 2022, from https://www.taxheaven.gr/news/6717/to-neo-taxisnet-einai-pleon-gegonos

Karapapas, K. (2019). Dikaiologitika. Πρόσβαση στο taxisnet αποκτούν οι υπηρεσίες των δήμων. (Municipal services gain access to taxisnet.) Ειδήσεις. Retrieved February 4, 2022, from https://www.dikaiologitika.gr/eidhseis/aftodioikisi/273991/prosvasi-sto-taxisnet-apoktoyn-oi-ypiresies-ton-dimon

Reader (2017, October 31). Reader. Το νέο taxisnet “λύνει” τα χέρια των πολιτών. (The new taxisnet “frees” citizens’ hands). Retrieved February 4, 2022, from https://www.reader.gr/oikonomia/231702/neo-taxisnet-lynei-ta-heria-ton-politon

Electronic Apartment Lease Taxisnet Approval (2021). Αvailable at: https://www.youtube.com/watch?v=Biz29Vpgkrk

Theoretical part – ROMANIA

Digitization is a type of process that, once initiated, can never be stopped. Therefore, the digitalization of Romania means the transition to a new paradigm – technological, informational and social.

Public institutions are just one of the key components of the digital transformation process. The private sector, the associative environment, local communities and society as a whole are equally essential parts of this process ( https://www.adr.gov.ro/adr/).

The digital tax system is part of the public authority’s strategy and unfortunately, the Romanian situation is not a very good one, even if in recent years there is an evolution in the use of e-government tools, the field of electronic public services remains underdeveloped. According to The Romanian Digitalization Authority “the main problem that best defines at a general, national level, the situation regarding e-government, is represented by insufficient development in Romania of electronic public services. This problem, which affects the entire population of the country, both public and private, places the country, despite the developments, still at the bottom of the international rankings relevant to the field”[1].

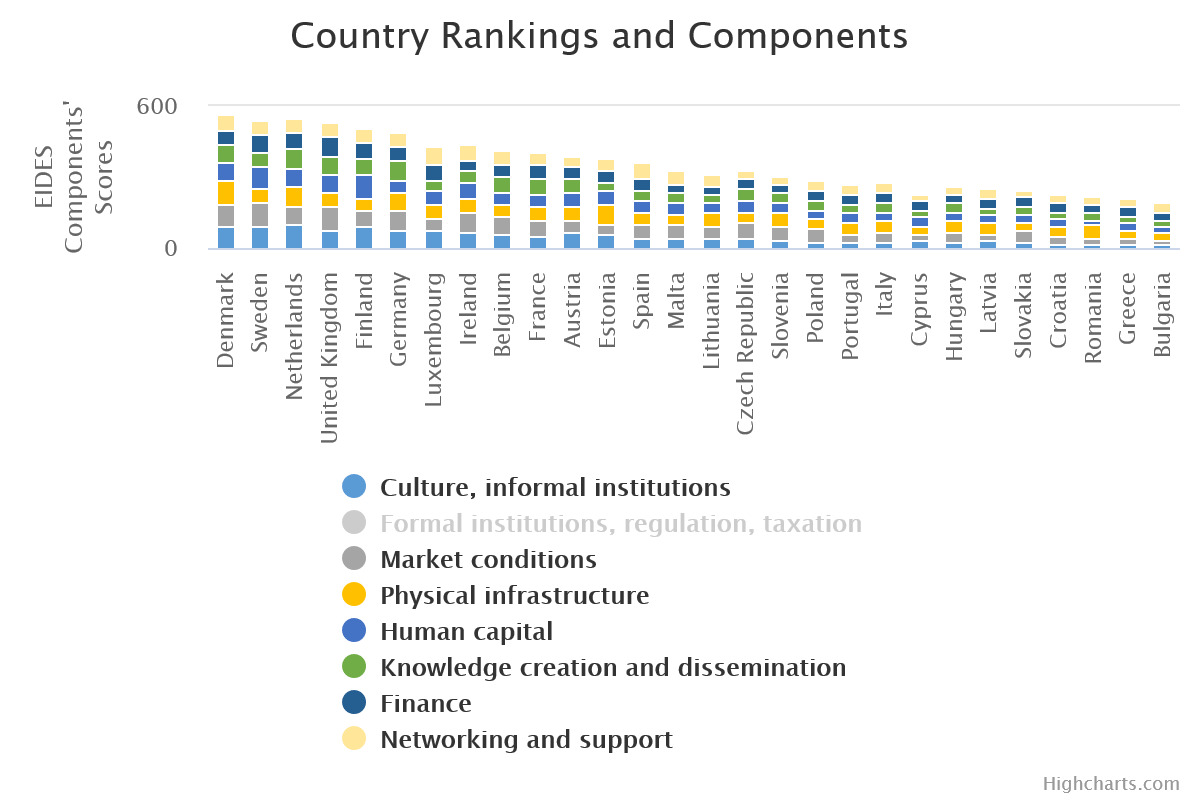

According to EIDES[2] in 2020 even if the index is associated with SMEs it is cklear that for tax point of view , onlu Greece and Bulgaria have a weak position in between . Having in mind one of the eight cathegory Formal Institutions, regulation, taxation Romania index ia 37,93 while Denmark is 77,98 and Luxemburg is 86,47.

Nevertheless, efforts are made, and some development was created dealing with life events for Romanian citizens. Some examples are presented as follows:

Public platforms:

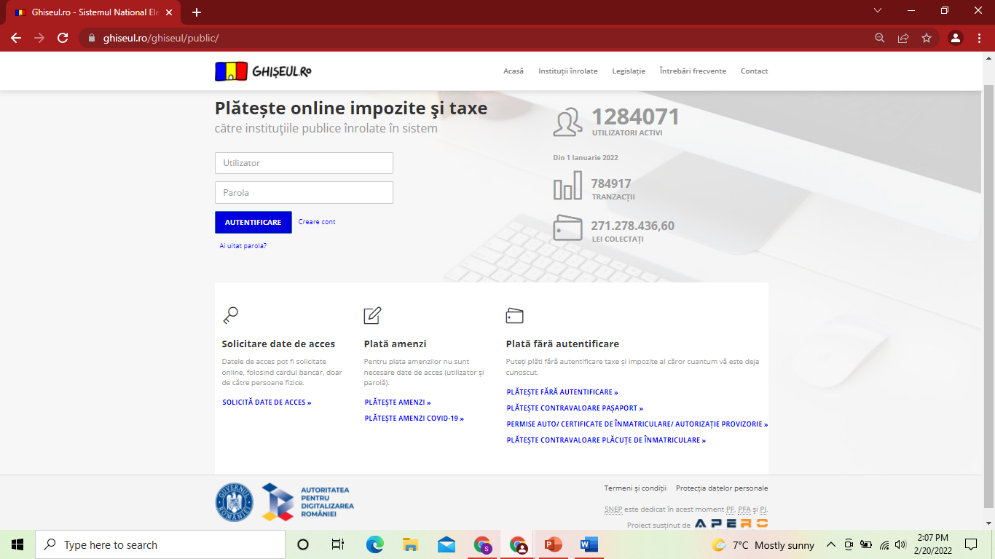

GHISEUL.ro https://ghiseul.ro – Sistemul National Electronic de Plata Online

The National Electronic Payment System (NEPS), also known as www.ghiseul.ro, is the system through which Romanians can pay their taxes online.

Ghiseul.ro system is managed and operated by the Agency for the Digital Agenda of Romania (ADAR); an institution subordinated to the Ministry for the Information Society (MIS). The online payment platform was made available free of charge by the Association for Electronic Payments in Romania (AEPR). This is an association that promotes electronic payments and consists of the 14 most important banks, international card schemes (VISA and MasterCard), processors and technology providers.

ANAF (National Authority for Fiscal Administration) https://www.anaf.ro/

The National Agency for Fiscal Administration (ANAF) was established on October 1, 2003 under the Ministry of Public Finance, by Government Ordinance no. 86/2003, as a specialized body of the central public administration. Starting with January 2004, it became operational, acquiring the quality of an institution with its own legal personality, by detaching the departments with attributions in the administration of state revenues within the Ministry of Public Finance.

Within ANAF, the Financial Guard, the National Customs Authority, the general directorates of the county public finances and the General Directorate of Public Finances of the Municipality of Bucharest are also organized.

As a specialized body of the central public administration, with attributions in the application of the fiscal administration policy, ANAF carries out its activity in the field of budget revenue administration, through the procedures of: management, collection, fiscal control and the development of partnership relations with taxpayers.

Since 1 January 2007, the date of Romania’s accession to the European Union, the Romanian Tax Administration has been providing for the intra-Community exchange of information on VAT and excise duties and adapting the administration, collection and control to the requirements of the tax administrations of the Member States of the European Union.

The society in which tax administrations have to operate is in a constant state of dynamism. Against this background, the activity of the Romanian Tax Administration is in a continuous process of modernisation and adaptation to economic realities, waiting for high quality and operational services.

Casa Națională de Pensii (National House of Public Pensions) https://www.cnpp.ro/home

The National House of Public Pensions is the Romanian public institution that provides pensions and other social insurance benefits due to persons included in the public pension system and accidents at work and occupational diseases, through territorial pension funds, as well as a series of benefits reparative character, established by special laws.

Private platforms:

There are some private platform performing tax/ bills payment such as

- SC VITAL SA (water,canal) https://plati.vitalmm.ro/login.jsp

SC VITAL S.A. provides clients with a new way of fast and permanent access to personalized information, online payment of invoices, self-read index transmissions, message transmissions to our company. In order to have access to these facilities, it is necessary to create a user account with the following information: email address, subscriber code, contract number.[3]

ELECTRICA SA (electricity / methane gas)

https://myelectrica.ro/index.php?pagina=plata-online

Provide clients with My Electrica platform to online payment of invoices, self-read index transmissions and other services.

Digi – https://www.digi.ro/plata

Clients can open an account and pay their invoices (telephone, internet, TV)

E-ON SA (methane gas) Autentificare clienti – E.ON Energie Romania

ROVIGNETE – vignettes https://www.roviniete.ro/ro/

Through this platform clients can pay RO and HU vignette, and can buy some mandatory romanian insurances (RCA).

Roviniete.ro is authorized by the National Company for Road Infrastructure Management (C.N.A.I.R. S.A.).

References

https://www.adr.gov.ro/adr/ – retreived February 3rd, 2022

ghiseul.ro – Sistemul National Electronic de Plata Online – retreived February 3rd 2022

https://www.anaf.ro/ – retreived February 3rd 2022

http://static.anaf.ro/static/10/Anaf/prezentare/prezentare.htm, retreived February 3rd, 2022

https://www.cnpp.ro/home – retreived February 3rd 2022

Theoretical part – POLAND

Every partner describes the solutions provided to the entrepreneurs by their government. Our goal is to give companies knowledge about those solutions in one place, helping them in the expansion of their companies on next foreign markets.

In Poland, the Ministry of Finance, enables entrepreneurs sharing the financial statements, VAT settlements and other tax statements via online platform “E-deklaracje” which can be translated as “e-declarations”. To use this solution, you need to possess the digital signature or other authorization method. Entrepreneurs widely known the digital signature, but in the other authorization methods we can include following:

- NIP or PESEL.

- Name or surname or date of birth.

- Information included in the previous declarations.

Using the methods of the digital signature or other authorization methods, you can send declarations related to:

- Goods and service tax.

- Tax on civil law transactions.

- Inheritance and donation tax.

- Income tax.

- Lump sum tax.

- Concerning obligations of the payer of personal income tax.

- Regarding gambling.

On the next pages of this manual, we will describe the most popular declarations which are made by the entrepreneurs in Poland.

Digital declarations in Poland. The Business Tax (PIT)

In Poland entrepreneurs, must send their declarations related to the business tax. Depending on the form of the taxation, they need to use the different declaration forms. The common declarations related to business tax are:

- PIT-16A.

- PIT-28.

- PIT-36.

- PIT-36L.

The PIT-16A is used by entrepreneurs who decide to adopt the tax card as a main tax tool to clearance with the fiscal administration. For entrepreneurs using the flat rate as a main form of taxation PIT-28 is a dedicated form to send to the fiscal administration.

PIT-36 is a declaration which is the statement of the entrepreneur about the amount of income earned or loss incurred in a tax year, there three types of the PIT-36, but the most common declaration is PIT-36L which is an information about the amount of income earned (loss incurred) in a tax year for business using the flat tax.

To be more precise what is the different about those business tax, we must describe the form of the taxation. The tax card (for PIT-16A) was one of the easiest ways to pay your tax the fiscal administration, the percentage of the tax needed to pay was set by the Minister of Finance. Currently due the “Nowy Ład” new companies and entrepreneurs who didn’t use this type of settlement with fiscal administration can’t use the tax card. The flat rate (for PIT-28) enables entrepreneurs using the tax percentage from 2% to 17% but the amount of tax depends on the service the entrepreneur does.

The tax scale (for PIT-36) is a tax system in which you pay 17% of tax when your income is not bigger than 120 thousand zlotych, but when you exceed this number, you will have to pay the 32% tax from the exceeded number. The Flat (PIT-36L) tax is the system where the entrepreneur is paying the 19% of tax without any limitation in the income.

The national system of e-invoice

From 2023 Poland will start the programe of the national e-invoice system which will be obligatory for all entrepreneurs in Poland who are registered as a VAT payer in our country, companies who are tax-exempt and companies who are covered by EU OSS procedure, but they have Polish National Tax number (NIP).

The system will enable entrepreneurs issue the invoices in the digital manner. As an entrepreneur you will be able to use the system prepared by the Ministry of Finance or buy commercial solutions.

“JPK_VAT” declaration

Micro, small, medium, and big enterprises are required to send the “JPK_VAT” declaration from October 2020. This declaration is as e-document, which is divided into two parts, but they are about value added tax. In the first part of the document, the company must send to the tax authorities the information about their purchase and sells of products/services which is already in the company documents. The second part the vat declaration which is also divided onto two separate files.

The vat declaration is divided on VAT-7M and VAT-7K. The difference is in the period of making the 7 is form settlement with the tax authorities. VAT-7M is for companies which are making the settlements every month and VAT-7K is for entrepreneurs who are doing settlements quarterly.

This document is very important for companies in Poland because you must be very strict to the dates of issuing this document. The companies must send it online till the 25th day of every month, the document covers the last month. What is important to mention that companies who makes their settlements quarterly must sent the “JPK_VAT” every month till 25th. Please pay attention to the days which are the 25th of the month, because when it is a Saturday, Sunday, or national holiday in Poland (which is a day off) you must send the document first working day.

Failure to comply with the obligation to submit this document will result in the imposition of an administrative penalty, we distinguish between two types of penalties:

- Tax offense:

- Penalty imposed by a fine: from PLN 210 to PLN 4 200,

- Penalty imposed by a court order: from PLN 210 to PLN 21 000,

- Penalty imposed by a court ruling: from PLN 210 to PLN 42 000.

- Fiscal crime:

- Penalty imposed by court order: from PLN 700 to PLN 5 600,000,

- Penalty imposed by a court sentence: from PLN 700 to PLN 20 160,000.

References

Ministry of Finance of the Republic of Poland. (2022). e-Deklaracja PIT. https://www.podatki.gov.pl/pit/e-deklaracje-pit/

Ministry of Finance of the Republic of Poland. (2022). Formularze elektroniczne dla prowadzących działalność gospodarczą. https://www.podatki.gov.pl/pit/e-deklaracje-pit/dla-osob-prowadzacych-dzialalnosc-gospodarcza/

Ministry of Finance of the Republic of Poland. (2022). Krajowy System e-Faktur. https://www.podatki.gov.pl/ksef/

Ministry of Finance of the Republic of Poland. (2022). JPK_VAT. https://www.podatki.gov.pl/jednolity-plik-kontrolny/jpk_vat/informacje-jpk-vat/

Theoretical part – SCOTLAND

HMRC

Her Majesty’s Revenue and Customs (HM Revenue and Customs or HMRC) is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers.[4]

The department is responsible for the administration and collection of direct taxes including Income Tax, Corporation Tax, Capital Gains Tax (CGT) and Inheritance Tax (IHT), indirect taxes including Value Added Tax (VAT), excise duties and Stamp Duty Land Tax (SDLT), and environmental taxes.

Making Tax Digital

Revenue and Customs Digital Technology Services (RCDTS) is a subsidiary of HMRC established in 2015 to provide technical and digital services.

This is the government’s plan for individuals and companies for tax issues so that the HRMC becomes one of the crudest tax administrations in the world.

Issues of potential impacts such as VAT, business and income have already been investigated and evaluated.

Making Tax Digital includes:

- Keeping and maintaining your VAT accounting records

- Creating VAT Returns

- Sending the VAT Returns to HMRC.[5]

VAT-registered businesses with a taxable turnover above the VAT threshold (.000 85,000) are now required to follow the Making Tax Digital rules by maintaining digital records and using software to file their VAT returns.

- It is compulsory to sign up for Making Tax Digital for VAT if the taxable turnoveris more than £85,000. But from April 2022 it will be compulsory for all the VAT-registered businesses.

- The first step is to find a software that’s compatible with Making Tax Digital for VAT. Using software will allow you to submit VAT Returns directly to HMRC without needing to visit HMRC’s website. In the following website you can use a tool to find the right software: https://www.tax.service.gov.uk/making-tax-digital-software?_ga=2.110751109.1061994407.1645194677-475971746.1642158399

- To sign up the following information is required: business email address, Government Gateway user ID and password, VATregistration number and latest VAT

- You should get a confirmation email from noreply@tax.service.gov.uk within 3 days of signing up.

Website to sign up: https://www.tax.service.gov.uk/vat-through-software/sign-up/are-you-ready-to submit?_ga=2.83954073.1061994407.1645194677%20475971746.1642158399

Figure 2 Website of Gov.Uk, https://www.access.service.gov.uk/login/signin/creds?aoc=Y

The following website offers all the important information regarding the procedure of signing up: https://www.gov.uk/vat-record-keeping/sign-up-for-making-tax-digital-for-vat

References

Report on the United Kingdom’s Digital Services Tax. (2013, January). OFFICE of the UNITED STATES TRADE REPRESENTATIVE EXECUTIVE OFFICE OF THE PRESIDENT. https://ustr.gov/sites/default/files/files/Press/Releases/UKDSTSection301Report.pdf

Overview of Making Tax Digital. (2021, September 21). GOV.UK. https://www.gov.uk/government/publications/making-tax-digital/overview-of-making-tax-digital

Government Digital Service. (2015, February 24). VAT record keeping. GOV.UK. https://www.gov.uk/vat-record-keeping/sign-up-for-making-tax-digital-for-vat

Wikipedia contributors. (2022, February 4). HM Revenue and Customs. Wikipedia. https://en.wikipedia.org/wiki/HM_Revenue_and_Customs

Wattanajantra, A. (2022, February 4). MTD for VAT FAQs: 19 key Making Tax Digital questions answered. Sage Advice United Kingdom. https://www.sage.com/en-gb/blog/mtd-for-vat-questions-answered/

Theoretical part – SLOVENIA

eTax (eDavki) portal

eDavki portal of Slovenia is active from 2003. eDavki use is free. eDavki portal enables convenient, easy and secure completion and submission of tax forms from the user’s computer at home or in the office.

The eDavki portal is the IT system of the Financial Administration of the Republic of Slovenia used in electronic transactions with the Financial Administration. It ensures the convenient, easy, and safe transmission of tax forms and receipt of documents served by the Financial Administration (eVročanje). The use of the portal (submission of forms and receipt of documents) is obligatory for all business entities. The legal representative of business entities (sole traders and legal entities) access to eDavki portal into the profile of business entities with a qualified digital certificate for employees, with a qualified digital certificate for a natural person, with a user account of a natural person or eDavki mobile application. An employee of business entity or an external provider access to eDavki portal into the profile of business entity only with a qualified digital certificate (under condition that such person has appropriate EDP rights granted) (Financial administration of the Republic of Slovenia, 2021).

eDavki is a safe web service that fully substitutes for the relevant paperwork. It offers several important advantages over processing of hard-copy tax forms:

- faster and easier completion of tax forms (with integrated help menus and tools for online checking),

- possibility of document filing 24 hours a day, 7 days a week, without mailing costs and irrespective of geographic location,

- access to tax card,

- data transfer directly from accounting system into eDavki through web services,

- easy authorization between users and other taxable persons,

- transfer of the extent of rights on the basis of eDavki operations through authorization (see authorisation in eTax).

In addition to other tax forms, through eDavki persons may submit their tax information returns for income tax assessment, and legal entities their VAT forms (e.g., VAT-O) and VIES. Users are also provided with the electronic services of e-commerce taxpayer registration and the exchange of their information with tax administrations of other EU Member States, as well as the verification of tax numbers of taxpayers from the EU (Financial administration of the RS, 2003–2022).

Access to the eDavki portal with a qualified digital certificate

Any taxable person can become an eDavki user. The application requires a computer with suitable software and Internet access.

If taxable persons use qualified digital certificates, they may file applications and receive documents via eDavki portal. edavki Appropriate equipment and an appropriate digital certificate are required. The procedure for obtaining a qualified digital certificate can be found on the eDavki eDavki portal. You may choose from among four qualified digital certificates (SIGEN-CA, POŠTA®CA, AC-NLB, and HALCOM CA) (Financial administration of the Republic of Slovenia, 2021).

References

Financial administration of the Republic of Slovenia. (2021). eDavki – electronic tax management system. Financial administration of the Republic of Slovenia. https://www.fu.gov.si/en/business_events_businesses/edavki_electronic_tax_management_system/

Financial administration of the RS. (2003-2022). PRESENTATION. eTax portal. Financial administration of the RS. https://edavki.durs.si/EdavkiPortal/OpenPortal/CommonPages/Opdynp/PageD.aspx?category=uvodportal

Ministrstvo za javno upravo. (2021). Predstavitev portala SPOT. [Video]. YouTube. https://youtu.be/7tPJ5kQRqag

[1] Barriers to Digitization public and private environment in Romania https://www.adr.gov.ro/wp-content/uploads/2021/04/ADR-Barierele-Digitalizarii-mediului-public-si-privat-din-Romania.pdf

[2] https://joint-research-centre.ec.europa.eu/european-index-digital-entrepreneurship-systems-eides/eides-country-ranks_en

[3] https://plati.vitalmm.ro/login.jsp visited 28.02.2022

[4] https://en.wikipedia.org/wiki/HM_Revenue_and_Customs

[5] https://www.sage.com/en-gb/blog/mtd-for-vat-questions-answered/

Ελληνικά

Ελληνικά Polski

Polski Română

Română Slovenščina

Slovenščina