Chapter 2: Digital tax systems in Europe

Greece

In the video link below, we can see the procedure for approving, or renewing the electronic apartment lease contract, through the AADE platform (ex-TAXISnet platform). Through very simple online steps, the interested part can issue, approve, or renew documentation, without any paperwork, or other bureaucratic procedures.

ELECTRONIC APARTMENT LEASE TAXISNET APPROVAL – YouTube

Romania

Efforts are made and some development has been made dealing with life events for Romanian citizens. Some examples are presented as follows.

Public platforms

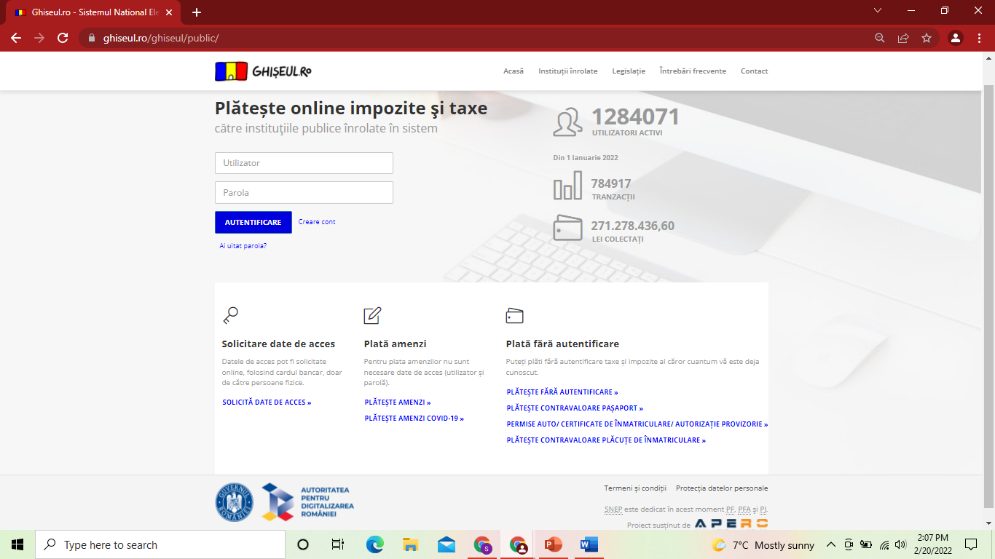

National Electronic Payment System (NEPS), GHISEUL.ro

Source: https://www.ghiseul.ro/ghiseul/public/

The National Electronic Payment System (NEPS), also known as www.ghiseul.ro, is the system through which Romanians can pay their taxes online.

Ghiseul.ro system is managed and operated by the Agency for the Digital Agenda of Romania (ADAR), an institution subordinated to the Ministry for the Information Society (MIS). The online payment platform was made available free of charge by the Association for Electronic

Payments in Romania (AEPR). This is an association that promotes electronic payments and consists of the 14 most important banks, international card schemes (VISA and MasterCard), processors and technology providers.

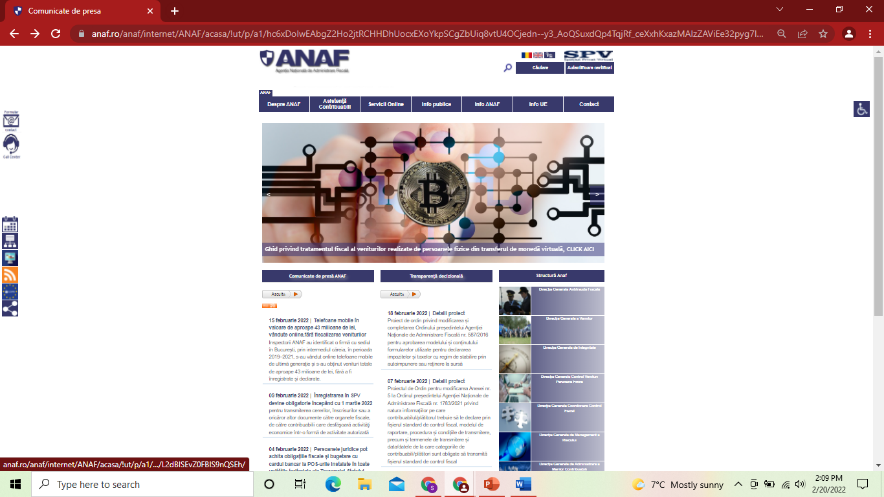

ANAF (National Authority for Fiscal Administration)

Source: https://www.anaf.ro/

The National Agency for Fiscal Administration (ANAF) was established on October 1, 2003 under the Ministry of Public Finance, by Government Ordinance no. 86/2003, as a specialized body of the central public administration. Starting with January 2004, it became operational, acquiring the quality of an institution with its own legal personality, by detaching the departments with attributions in the administration of state revenues within the Ministry of Public Finance.

Within ANAF, the Financial Guard, the National Customs Authority, the general directorates of the county public finances and the General Directorate of Public Finances of the Municipality of Bucharest are also organized and function.

As a specialized body of the central public administration, with attributions in the application of the fiscal administration policy, ANAF carries out its activity in the field of budget revenue administration, through the procedures of: management, collection, fiscal control and the development of partnership relations with taxpayers.

Starting with January 1, 2007, the date of Romania’s accession to the European Union, the Romanian tax administration ensures the exchange of intra-community information regarding value added tax and excise duties, as well as adapting the management, collection and control process to meet the requirements of tax administrations. of the Member States of the European Union.

The company in which the tax administrations have to operate is in a continuous dynamic. Against this background, the activity of the Romanian tax administration is in a continuous process of modernization and adaptation to economic realities, the company being waiting for high quality and operative services.

Casa Națională de Pensii (National House of Public Pensions)

Source: https://www.cnpp.ro/home

The National House of Public Pensions is the Romanian public institution that provides pensions and other social insurance benefits due to persons included in the public pension system and accidents at work and occupational diseases, through territorial pension funds, as well as a series of benefits reparative character, established by special laws.

Private platforms:

There are some private platform performing tax/ bills payment such as

SC VITAL SA (water,canal)

https://plati.vitalmm.ro/login.jsp

SC VITAL S.A. provides clients with a new way of fast and permanent access to personalized information, online payment of invoices, self-read index transmissions, message transmissions to our company. In order to have access to these facilities, it is necessary to create a user account with the following information: email address, subscriber code, contract number.[1]

ELECTRICA SA (electricity / methane gas) https://myelectrica.ro/index.php?pagina=plata-online

Provide clients with My Electrica platform to online payment of invoices, self-read index transmissions and other services.

Digi

Clients can open an account and pay their invoices ( telephone, internet, TV).

E-ON SA (methane gas) Autentificare clienti – E.ON Energie Romania

https://www.eon.ro/myline/login

It concerns gas payments.

ROVIGNETE – vignettes

Through this platform clients can pay RO and HU vignette, and can buy some mandatory romanian insurances (RCA). Roviniete.ro is authorized by the National Company for Road Infrastructure Management (C.N.A.I.R. S.A.).

Poland

Digital tax systems in Poland are a new and easy way of paying taxes without the need for a personal visit to a real office. This is a practical solution for citizens and entrepreneurs.

Marciniuk i Wspólnicy Sp. z o.o. (http://www.marciniuk.com/index.php) they provide accounting services and tax and legal advice. Their services are offered in Polish, German and English. Thanks to their experience, they fully support their customers, especially foreign organizations present on the Polish market or entering Poland. The team’s outstanding expertise and experience translates into high quality consulting services and is consistently reflected in high positions in rankings, titles and awards. They give advice on the international reorganization of business entities, advice on choosing the most effective form of business in Poland based on solutions arising from international agreements, EU directives and Polish and foreign legislation as well as advice on seconding international personnel within a Company.

Crowe Global – (https://www.crowe.com/pl/services/doradztwo-podatkowe) provides clients with daily support in the areas of CIT, PIT and VAT as well as support in areas selected by the company. Such as tax services for investments, tax advice in the process of M&A activities, preparation of transfer pricing documents, assistance in taking advantage of tax advantages and declaration of tax regimes of MDR. They provide assistance in selecting optimal tax solutions and in complying with administrative and reporting obligations arising from applicable regulations, both nationally and internationally in English.

E-Urząd Skarbowy – (https://podatki.gov.pl/e-urzad-skarbowy/) is a Ministry of Finance project that provides citizens and entrepreneurs with effective online tools to deal with complex issues, mainly in the areas of VAT, PIT and CIT. Facilitate the fulfilment of tax obligations, including the payment of taxes, through online electronic payment services. E-Urząd Skarbowy allows taxpayers, legal entities or unincorporated entities to access tax information relating to them. Impacts of this project include reducing the time required to comply with tax obligations, simplifying the preparation and submission of information/data and forms, and integrating data across various systems.

Scotland

The following video it is a useful guide on how to sign up for Making Tax Dig

Making Tax Digital is a key part of the government’s Tax Administration Strategy. It helps reducing the tax gap by requiring businesses and individuals to:

- keep digital records

- use software that works with Making Tax Digital

- submit updates every quarter, bringing the tax system closer to real-time

You can find information also at www.gov.uk

Slovenia

eTax (https://edavki.durs.si/) portal enables convenient, easy and secure completion and submission of tax forms from the user’s computer at home or in the office.

In addition to other tax forms, through eTax natural persons may submit their tax information returns for income tax assessment, and legal entities their VAT forms (e.g., VAT-O) and VIES. Users are also provided with the electronic services of e-commerce taxpayer registration and the exchange of their information with tax administrations of other EU Member States, as well as the verification of tax numbers of taxpayers from the EU.

Any taxable person can become an eTax user. The application requires a computer with suitable software and Internet access.

Ελληνικά

Ελληνικά Polski

Polski Română

Română Slovenščina

Slovenščina