GREECE

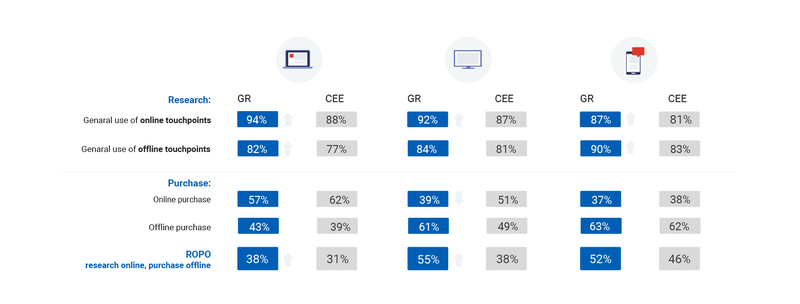

Consumers in Greece take time to search and use more interfaces than shoppers across the CEE region. IPSOS and Google CEE1 polled 4,500 customers about a variety of items and services, including notebook computers, televisions, and mobile phone contracts.

Greek customers, in comparison to their regional counterparts, spend more time searching across interfaces and prefer to make offline purchases. Between 25% and 40% of Greek customers did not have a specific brand in mind at the start of the purchasing process. The fact is that many customers aren’t loyal to brands; rather they are devoted to products and services that make the most sense to them at the moment of decision making. Greek consumers are more ready to do in-depth research across both online interfaces and physical stores. They use more interfaces and search through them so much more frequently than their regional counterparts.

Figure 8 Source: Protasiuk, 2019

Greeks are careful bargain seekers who spend their time searching price comparison websites, product specifications pages, while looking for ideas. The majority of customers are comparing costs and looking for specials, but a sizable percentage are seeking for inspiration and what’s on the market (Protasiuk, 2019).

As far as COVID-19 period is concerned, Greeks have slightly altered their shopping habits. The findings of the Future Consumer Index Greece 2021 survey clearly show that individuals are not merely consuming more items and services at home. Their entire lives are being rebuilt around their homes.

Consumers in Greece are most concerned about the economic impact of the pandemic. As a result, individuals prefer to spend less today, purchasing only what is absolutely necessary and saving more. Over the next three years, this tendency is unlikely to change. By far the most important purchase factor will remain price. Greeks will continue to spend the same amount on most things as they did during the pandemic, and in the few cases where they will modify their spending, it will be primarily downward. Many customers indicate they are willing to pay more for products that have unique features. Items made in Greece, high-quality products, and products that offer comfort, practicality, and convenience are among them. Consumers’ willingness to pay a premium for a product, on the other hand, differs significantly between demographic groups (Mavros, 2021).

Social Shopping in Greece.

Social commerce services, such as the Commerce Manager of Facebook for sales on Facebook and Instagram, are currently not available in Greece (Synergic, 2020).

According to a NielsenIQ survey of 850 Greeks online last September-October, 6 out of 10 said they had already bought from online shops, through social media platforms, with new age groups remaining the main driver of the channel. Facebook remains the most popular platform for buying goods on social networks, with 52% of online shoppers in Greece using it for this purpose. It is followed by Instagram, which is preferred by the younger generation (18-24 years old) – with almost half (49%) of respondents in this group saying that they use Instagram for online shopping.

Figure 9 Source: Synergic, 2020

The rise of social commerce is associated with an increase in the use of social media and the average time that some people spend on them. In Greece, 7 out of 10 Greeks said that they increased the time they spent on social media from the start of the lockdown from last March until today (Gkitsi, 2021). The growing amount of time most people, especially the younger generations, are devoting to social media applications has made social commerce an undisputed trend for e-commerce in the upcoming years. Equally important is the emerging preference of young users on social networking platforms with video and photos as the main content. This fact is confirmed by the significant percentage of young people moving from Facebook to platforms such as ΥouΤube, Ιnstagram and Snapchat. This is a very important parameter that companies should include in the preparation of their marketing strategy for the upcoming years (Synergic, 2020).

References

Protasiuk, M. (2019). Particularly greek: The modern path to purchase in Greece. Google. Retrieved February 10, 2022, from https://www.thinkwithgoogle.com/intl/en-cee/consumer-insights/consumer-journey/particularly-greek-modern-path-purchase-greece/

Mavros, T. (2021, June 10). As Greek consumers keep adapting, how ready is your business to respond? EY US – Home. Retrieved February 10, 2022, from https://www.ey.com/en_gr/future-consumer-index/as-greek-consumers-keep-adapting-how-ready-is-your-business-to-respond

Synergic. (2020, April 1). To Ηλεκτρονικό Εμπόριο σήμερα, eCommerce trends. (The E-Commerce today. E-Commerce Trends) Retrieved February 10, 2022, from https://synergic.gr/el/ilektroniko-emporio-ecommerce-b2b-b2c

Gkitsi, A. (2021). Ξεχάστε τα eshops, ζήτω το Social Commerce. (Forget eshops, long live Social Commerce) Capital.gr. Retrieved February 10, 2022, from

https://www.capital.gr/epixeiriseis/3526791/xexaste-ta-eshops-zito-to-social-commerce

Ελληνικά

Ελληνικά Polski

Polski Română

Română Slovenščina

Slovenščina