SCOȚIA

HMRC

Administrația fiscală și vamală a Majestății Sale (HM Revenue and Customs sau AFVM) este un departament non-ministerial al guvernului Regatului Unit responsabil cu colectarea impozitelor, plata unor forme de sprijin de stat, administrarea altor regimuri de reglementare, inclusiv salariul minim național și emiterea numerelor naționale de asigurare.( https://en.wikipedia.org/wiki/HM_Revenue_and_Customs )

Departamentul este responsabil de administrarea și colectarea impozitelor directe, inclusiv impozitul pe venit, impozitul pe profit, impozitul pe câștigurile de capital ( CGT) și impozitul pe moștenire (IHT), impozitele indirecte, inclusiv taxa pe valoarea adăugată (TVA), accizele și taxa pe terenurile de timbru (SDLT) și taxele de mediu.

Impozitarea digitală

Servicii de tehnologie digitală a veniturilor și a serviciilor vamale (STDVSV) este o filială a AFVM înființată în 2015 pentru a furniza servicii tehnice și digitale.

Acesta este planul guvernului pentru persoane fizice și companii pentru probleme fiscale, astfel încât AFVM să devină una dintre cele mai mari administrații fiscale din lume.

Aspecte legate de impactul potențial, cum ar fi TVA-ul, întreprinderile și veniturile, au fost deja investigate și evaluate.

Impozitarea digitală include:

- Păstrarea și menținerea evidențelor contabile privind TVA

- Crearea de declarații de TVA

- Trimiterea declarațiilor de TVA la AFVM.( https://www.sage.com/en- gb/blog/mtd-for-vat-questions-answered/)

Întreprinderile înregistrate, platitoare de TVA, cu o cifră de afaceri impozabilă care depășește pragul de TVA (.000 85.000) sunt acum obligate să respecte normele privind realizarea de servicii digitale prin păstrarea înregistrărilor digitale și prin utilizarea unui software pentru depunerea declarațiilor de TVA.

- Este obligatoriu să vă înscrieți la Impozitarea Digitală pentru TVA în

cazul în care cifra de afaceri impozabilă este mai mare de 85.000 de lire sterline. Dar din aprilie 2022 va fi obligatoriu pentru toate întreprinderile înregistrate în scopuri de TVA.

- Primul pas pentru a găsi un software care este compatibil cu Impozitarea Digitală pentru TVA. Utilizarea software-ului vă va permite să depuneți declarațiile de TVA direct la AFVM fără a fi nevoie să vizitați site-ul AFVM. Pe următorul site web puteți utiliza un instrument pentru a găsi software-ul potrivit: https://www.tax.service.gov.uk/making-tax- digital-software?_ga=2.110751109.1061994407.1645194677- 1642158399

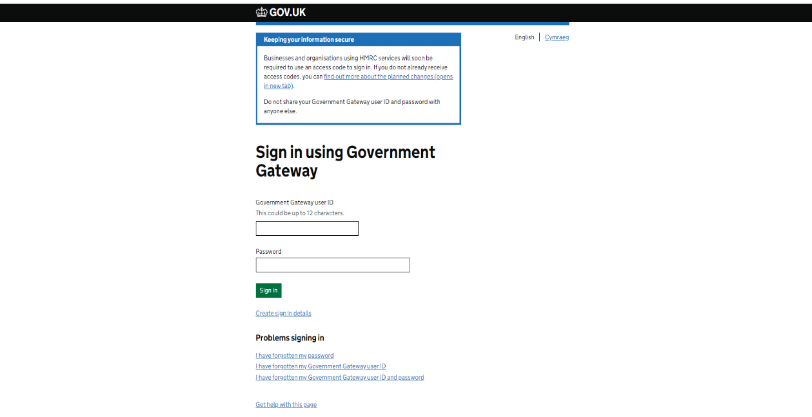

- Pentru a vă înscrie, sunt necesare următoarele informații: adresa de e- mail de afaceri, ID-ul de utilizator al portalului guvernamental și parola, numărul de înregistrare în scopuri de TVA și ultima declarație de

- Ar trebui să primiți un e-mail de confirmare de la

noreply@tax.service.gov.uk în termen de 3 zile de la înregistrare.

Site-ul web pentru a vă înscrie: https://www.tax.service.gov.uk/vat-through- software/sign-up/are-you-ready-to de prezentare?_ga=2.83954073.1061994407.1645194677 %20475971746.1642158399

Figura 2 Website of Gov.Uk, https://www.access.service.gov.uk/login/signin/creds?aoc=Y

Următorul site web oferă toate informațiile importante cu privire la procedura de înregistrare: https://www.gov.uk/vat-record-keeping/sign-up-for-making-tax- digital-for-vat

Referințe

Raportul privind taxa pe serviciile digitale a Regatului Unit. (2013, ianuarie). Biroul STATELOR UNITE COMERCIALE EXECUTIVE OFFICE AL PREZENTULUI.

https://ustr.gov/sites/default/files/files/Press/Releases/UKDSTSection301Repo rt.pdf

Prezentare generală a procesului de realizare a digitalizării fiscale. (2021, 21 septembrie). GOV.UK. https://www.gov.uk/government/publications/making- tax-digital/overview-of-making-tax-digital

Serviciul Digital al Guvernului. (2015, 24 februarie). Păstrarea evidenței TVA. GOV.UK. https://www.gov.uk/vat-record-keeping/sign-up-for-making-tax- digital-for-vat

Contribuitori la Wikipedia. (2022, 4 februarie). HM Revenue and Customs. Wikipedia. https://en.wikipedia.org/wiki/HM_Revenue_and_Customs Wattanajantra, A. (2022, 4 februarie). MTD pentru întrebări frecvente privind TVA: 19 întrebări cheie privind impozitarea digitală au răspuns. Sage Advice Marea Britanie. https://www.sage.com/en-gb/blog/mtd-for-vat-questions- answered/

English

English Ελληνικά

Ελληνικά Polski

Polski Slovenščina

Slovenščina