ΡΟΥΜΑΝΙΑ

Η ψηφιοποίηση είναι ένα είδος διαδικασίας που, αφού ξεκινήσει, δεν πρόκειται να σταματήσει ποτέ. Ως εκ τούτου, η ψηφιοποίηση της Ρουμανίας σημαίνει τη μετάβαση σε ένα νέο παράδειγμα – τεχνολογικό, πληροφοριακό και κοινωνικό.

Οι δημόσιοι οργανισμοί αποτελούν μόνο ένα από τα βασικά στοιχεία της διαδικασίας ψηφιακού μετασχηματισμού. Ο ιδιωτικός τομέας, το συνεταιριστικό περιβάλλον, οι τοπικές κοινότητες και η κοινωνία στο σύνολό της αποτελούν εξίσου σημαντικά στοιχεία αυτής της διαδικασίας (https://www.adr.gov.ro/adr/).

Το ψηφιακό φορολογικό σύστημα αποτελεί μέρος της στρατηγικής της δημόσιας αρχής και δυστυχώς, η κατάσταση στη Ρουμανία δεν είναι ικανοποιητική, παρόλο που τα τελευταία χρόνια παρατηρείται μια εξέλιξη στη χρήση εργαλείων ηλεκτρονικής διακυβέρνησης, ο τομέας των ηλεκτρονικών δημόσιων υπηρεσιών παραμένει υποβαθμισμένος. Σύμφωνα με την Αρχή Ψηφιοποίησης της Ρουμανίας “το κύριο πρόβλημα που προσδιορίζει καλύτερα σε γενικό, εθνικό επίπεδο, την κατάσταση όσον αφορά την ηλεκτρονική διακυβέρνηση, αντιπροσωπεύεται από την ανεπαρκή ανάπτυξη των ηλεκτρονικών δημόσιων υπηρεσιών στη Ρουμανία. Το πρόβλημα αυτό, το οποίο επηρεάζει το σύνολο του πληθυσμού της χώρας, τόσο του δημόσιου όσο και του ιδιωτικού τομέα, τοποθετεί τη χώρα, παρά τις εξελίξεις, ακόμη στον πυθμένα των διεθνών κατατάξεων που σχετίζονται με τον τομέα αυτό”[1].

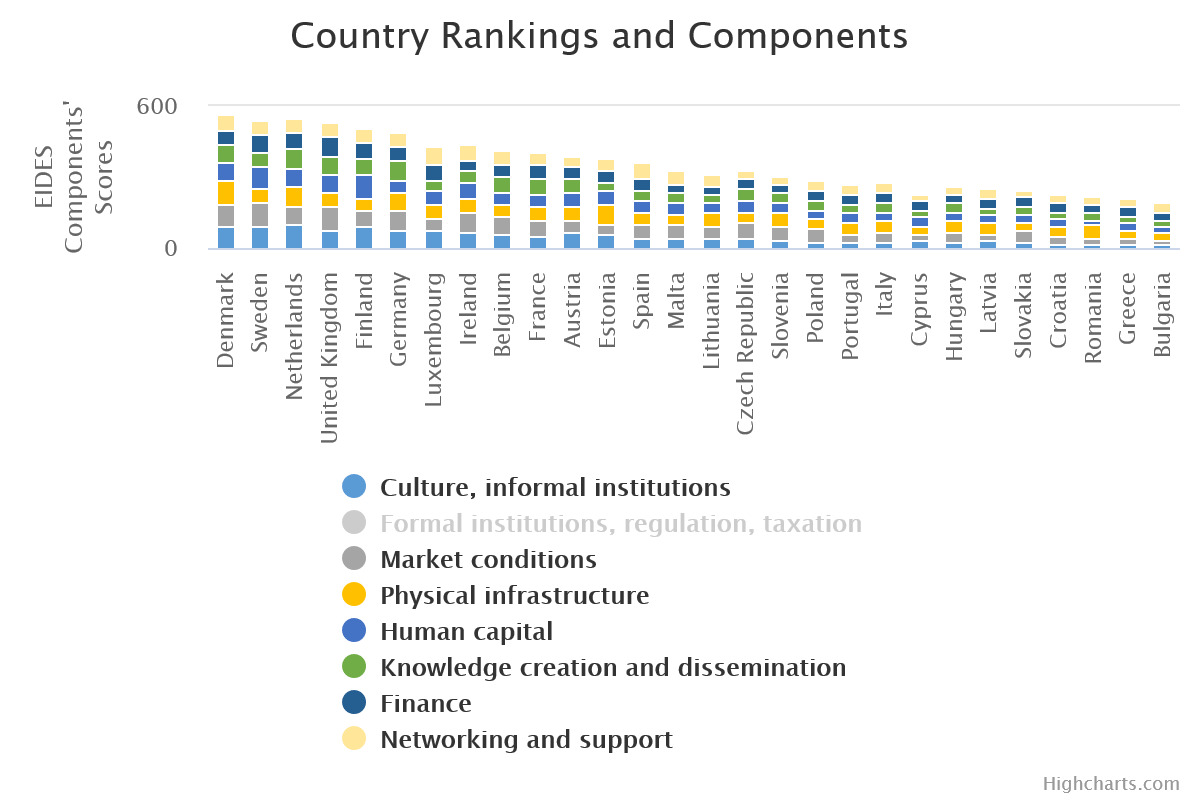

Σύμφωνα με την EIDES[2] το 2020, ακόμη και αν ο δείκτης σχετίζεται με τις μικρομεσαίες επιχειρήσεις, είναι σαφές ότι από φορολογική άποψη, η Ελλάδα και η Βουλγαρία κατέχουν μια χαμηλή θέση στο ενδιάμεσο. Λαμβάνοντας υπόψη μία από τις οκτώ κατηγορίες, όπως οι Τυπικοί θεσμοί, ρύθμιση, φορολογία, ο δείκτης της Ρουμανίας είναι 37,93, ενώ η Δανία είναι 77,98 και το Λουξεμβούργο 86,47.

Παρόλα αυτά, καταβάλλονται προσπάθειες και δημιουργήθηκε κάποια ανάπτυξη που αφορά τα γεγονότα της ζωής των Ρουμάνων πολιτών. Παρακάτω παρατίθενται μερικά παραδείγματα:

Δημόσιες πλατφόρμες:

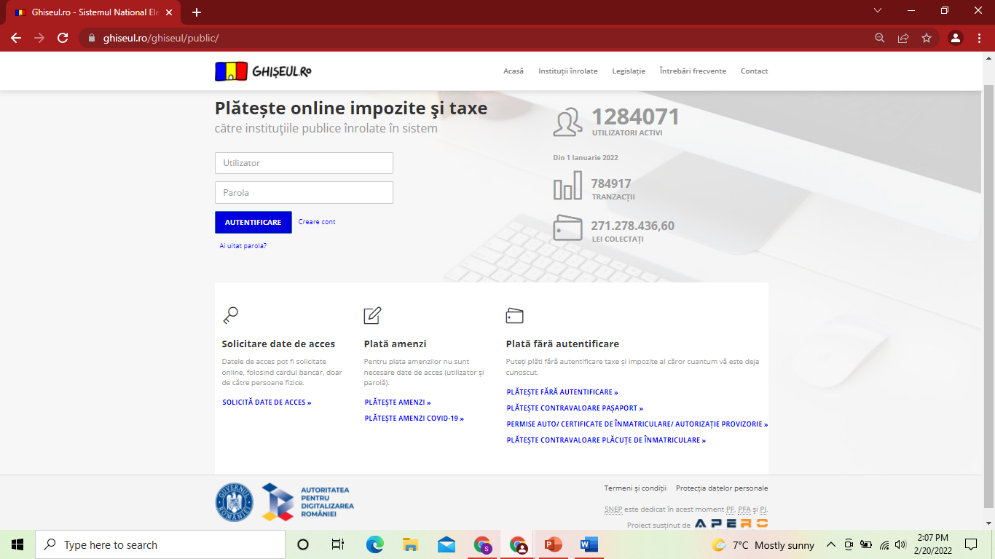

GHISEUL.ro https://ghiseul.ro – Sistemul National Electronic de Plata Online

Το Εθνικό Ηλεκτρονικό Σύστημα Πληρωμών (NEPS), γνωστό και ως www.ghiseul.ro, είναι το σύστημα μέσω του οποίου οι Ρουμάνοι μπορούν να πληρώνουν ηλεκτρονικά τους φόρους τους.

Το σύστημα Ghiseul.ro ελέγχεται και λειτουργεί από τον Οργανισμό για την Ψηφιακή Ατζέντα της Ρουμανίας (ADAR), έναν οργανισμό που υπάγεται στο Υπουργείο για την Κοινωνία της Πληροφορίας (MIS). Η ηλεκτρονική πλατφόρμα πληρωμών διατίθεται δωρεάν από την Ένωση Ηλεκτρονικών Πληρωμών στη Ρουμανία (AEPR). Πρόκειται για μια ένωση που προωθεί τις ηλεκτρονικές πληρωμές και αποτελείται από τις 14 σημαντικότερες τράπεζες, διεθνή συστήματα καρτών (VISA και MasterCard), επεξεργαστές και παρόχους τεχνολογίας.

ANAF (National Authority for Fiscal Administration) https://www.anaf.ro/

Ο Εθνικός Οργανισμός Φορολογικής Διοίκησης (ANAF) ιδρύθηκε την 1η Οκτωβρίου 2003 στο πλαίσιο του Υπουργείου Δημόσιων Οικονομικών, με το κυβερνητικό διάταγμα αριθ. 86/2003, ως εξειδικευμένος φορέας της κεντρικής δημόσιας διοίκησης. Από τον Ιανουάριο του 2004, άρχισε να λειτουργεί, αποκτώντας την ιδιότητα ενός οργάνου με δική του νομική προσωπικότητα, διαχωρίζοντας τις υπηρεσίες με αρμοδιότητες στη διαχείριση των κρατικών εσόδων εντός του Υπουργείου Δημόσιων Οικονομικών.

Στο πλαίσιο της ANAF, οργανώνονται επίσης η Οικονομική Φρουρά, η Εθνική Τελωνειακή Αρχή, οι γενικές διευθύνσεις δημόσιων οικονομικών των νομών και η Γενική Διεύθυνση Δημόσιων Οικονομικών του Δήμου Βουκουρεστίου.

Ως εξειδικευμένος φορέας της κεντρικής δημόσιας διοίκησης, με αρμοδιότητες στην εφαρμογή της πολιτικής δημοσιονομικής διαχείρισης, η ANAF δραστηριοποιείται στον τομέα της διαχείρισης των εσόδων του προϋπολογισμού, μέσω των διαδικασιών: διαχείρισης, είσπραξης, φορολογικού ελέγχου και ανάπτυξης εταιρικών σχέσεων με τους φορολογούμενους.

Από την 1η Ιανουαρίου 2007, ημερομηνία προσχώρησης της Ρουμανίας στην Ευρωπαϊκή Ένωση, η Ρουμανική Φορολογική Διοίκηση προβλέπει την ενδοκοινοτική ανταλλαγή πληροφοριών σχετικά με τον ΦΠΑ και τους ειδικούς φόρους κατανάλωσης και προσαρμόζει τη διαχείριση, την είσπραξη και τον έλεγχο στις απαιτήσεις των φορολογικών διοικήσεων των κρατών μελών της Ευρωπαϊκής Ένωσης.

Η κοινωνία στην οποία πρέπει να λειτουργούν οι φορολογικές διοικήσεις βρίσκεται σε συνεχή εξέλιξη. Σε αυτό το πλαίσιο, η δραστηριότητα της ρουμανικής φορολογικής διοίκησης βρίσκεται σε συνεχή διαδικασία εκσυγχρονισμού και προσαρμογής στην οικονομική πραγματικότητα, περιμένοντας υπηρεσίες υψηλής ποιότητας και λειτουργικότητας.

Εθνικός Οίκος Δημοσίων Συντάξεων (Casa Națională de Pensii) https://www.cnpp.ro/home

Ο Εθνικός Οίκος Δημόσιων Συντάξεων είναι ο ρουμανικός δημόσιος φορέας που παρέχει συντάξεις και άλλες παροχές κοινωνικής ασφάλισης που οφείλονται σε πρόσωπα που περιλαμβάνονται στο δημόσιο συνταξιοδοτικό σύστημα και σε εργατικά ατυχήματα και επαγγελματικές ασθένειες, μέσω εδαφικών συνταξιοδοτικών ταμείων, καθώς και μια σειρά παροχών επανορθωτικού χαρακτήρα, που θεσπίζονται με ειδικούς νόμους.

Ιδιωτικές πλατφόρμες:

Υπάρχουν ορισμένες ιδιωτικές πλατφόρμες που εκτελούν πληρωμές φόρων/ λογαριασμών, όπως:

SC VITAL SA (ύδρευση, κανάλια)

https://plati.vitalmm.ro/login.jsp

Η SC VITAL S.A. παρέχει στους πελάτες έναν νέο τρόπο γρήγορης και μόνιμης πρόσβασης σε εξατομικευμένες πληροφορίες, ηλεκτρονική πληρωμή τιμολογίων, αυτοαναγνώριση ευρετηρίων, αποστολή μηνυμάτων προς την εταιρεία. Για να έχετε πρόσβαση σε αυτές τις δυνατότητες, είναι απαραίτητο να δημιουργήσετε έναν λογαριασμό χρήστη με τις ακόλουθες πληροφορίες: διεύθυνση ηλεκτρονικού ταχυδρομείου, κωδικός συνδρομητή, αριθμός σύμβασης.[1]

ELECTRICA SA (ηλεκτρικό ρεύμα / αέριο μεθανίου)

https://myelectrica.ro/index.php?pagina=plata-online

Παρέχει στους πελάτες την πλατφόρμα My Electrica για την ηλεκτρονική πληρωμή των τιμολογίων, την αυτόματη ανάγνωση των δεικτών μετάδοσης καθώς και άλλες υπηρεσίες.

Digi – https://www.digi.ro/plata

Οι πελάτες μπορούν να ανοίξουν λογαριασμό και να πληρώσουν τα τιμολόγιά τους (τηλέφωνο, ίντερνετ, τηλεόραση).

E-ON SA (αέριο μεθανίου) Autentificare clienti – E.ON Energie Romania

ROVIGNETE – (βινιέτες) https://www.roviniete.ro/ro/

Μέσω αυτής της πλατφόρμας οι πελάτες μπορούν να πληρώσουν ρουμανικές και ουγγρικές βινιέτες και μπορούν να αγοράσουν ορισμένες υποχρεωτικές ρουμανικές ασφάλειες (RCA).

Η Roviniete.ro είναι εξουσιοδοτημένη από την Εθνική Εταιρεία Διαχείρισης Οδικών Υποδομών (C.N.A.I.R. S.A.).

Βιβλιογραφικές αναφορές

https://www.adr.gov.ro/adr/ – ανακτήθηκε στις 3 Φεβρουαρίου 2022

ghiseul.ro – Sistemul National Electronic de Plata Online – ανακτήθηκε στις 3 Φεβρουαρίου 2022

https://www.anaf.ro/ – ανακτήθηκε στις 3 Φεβρουαρίου 2022

http://static.anaf.ro/static/10/Anaf/prezentare/prezentare.htm, ανακτήθηκε στις 3 Φεβρουαρίου 2022

https://www.cnpp.ro/home – ανακτήθηκε στις 3 Φεβρουαρίου 2022

[1] https://plati.vitalmm.ro/login.jsp visited 28.02.2022

[1] Barriers to Digitization public and private environment in Romania https://www.adr.gov.ro/wp-content/uploads/2021/04/ADR-Barierele-Digitalizarii-mediului-public-si-privat-din-Romania.pdf

[2] https://joint-research-centre.ec.europa.eu/european-index-digital-entrepreneurship-systems-eides/eides-country-ranks_en

[3] https://plati.vitalmm.ro/login.jsp visited 28.02.2022

English

English Polski

Polski Română

Română Slovenščina

Slovenščina